The outlook for listed property amid COVID-19

By Michael Arbuthnot, CEO of Catalyst Fund Managers

Current economic backdrop

Due to the impact of COVID-19 and the subsequent lockdown, the global economy has basically come to a halt. Property will be amongst the most impacted sectors as many businesses will not be able to afford their rent should they not earn revenue.

As these lockdowns are extended, they push more companies and individuals into financial distress, causing wide-scale unemployment and bankruptcies across the board. This will severely hamper long-term economic recovery. Within real estate, the lockdown will severely hamper near-term rent collections and the longer-term demand dynamics for real estate space.

Post the COVID-19 crisis, as the economy returns to ‘normal’, property companies will again continue to generate sustainable cashflows.

How is COVID-19 impacting property returns?

With property, the total return = income + income growth.

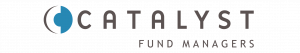

Listed property exhibits varying levels of both equity- and bond-like traits over time. One also needs to appreciate how a listed property asset’s total return over the long term is composed. When taking stock of one’s overall portfolio, these two characteristics – income and income growth – continue to make listed property such a good diversifier. While these have led to listed property’s mainstream acceptance as a separate asset class, it continues to play an important role and complement the other asset classes.

Listed property shares’ returns are influenced by the rise or fall in their share price resulting in capital gains or losses (similar to equities). In addition to share price growth, investors receive regular income distributions from the rental income that the property companies earn (similar to bonds which offer a consistent income stream). The income yield has historically made up about 40% of listed property investors’ total returns, with the balance coming from capital growth.

Chart 1: Annual income and capital returns of SA listed property

Source: Catalyst Fund Managers & Bloomberg | Data up to 31 December 2019

In a normal environment, property shares are typically seen as less risky than other equities because of this relatively stable rental income stream. Currently, one of the concerns for investors seeking to increase exposure to listed property is what the impact of COVID-19 and subsequent shutting down of the economy will be on the sustainability of rental income.

For example, the top five fashion tenants in malls have offered to pay 20% of the contracted rental for the duration of the ‘hard’ lockdown.

Pre-COVID19, the total return was predominantly driven by the dividend yield with little to no growth over the short to medium term. In the current scenario we do believe both distributable earnings (what they can actually pay out) and the dividend will be under pressure. Given the uncertainty in the market, a few companies have already cancelled/postponed their dividend payments in order to use the cashflow as a balance sheet buffer until there is more certainty. Most SA companies have Loan to Value ratios (LTVs) ranging between 30% and 40% (average closer to 40% on a see-through basis). To preserve their balance sheets, any interim dividends are expected to be delayed until the financial year-end. We support this as balance sheet preservation is of utmost importance. This will be driven by the ability or affordability to pay and potential rules relaxation by regulators regarding tax and REIT status. REITs are looking at ways to mitigate the tax risk and are engaging with the relevant government departments. The JSE has also noted the negative consequences of the loss of REIT status, due to failure to pay dividends, will have on most stakeholders and noted that it is working closely with the SA REIT association to address this matter.

Listed property outlook: South Africa

Over the next year or two we are looking at a substantial reduction in distributable income due to the immediate impact of the lockdown. After that, we expect to gradually get distributable income growth as the impact of COVID-19 dissipates over time. Despite seeing ‘growth’, the reality is that it is driven by a rebase in the current year as opposed to organic growth prospects. The situation remains very uncertain and compounding the uncertainty is the fact that the majority of the SA REITs are exposed to retail and office space with limited diversification into other sectors.

Another risk during these times is that landlords are subject to the risk of tenant bankruptcies. As investors, it is important to assess these risks and ensure that landlords are well diversified and not over-exposed to a single tenant or sector of the market.

For example, Edcon filed for voluntary business rescue on 29 April and opened for trade under Level 4 restrictions on Friday, 1 May. Edcon will be allowed to sell most items, but will do so under strict business rescue conditions. Edcon currently represents less than 1% of SA listed property rental income. If Edcon were to not survive post this business rescue, then we expect that over time the space will be leased out to new tenants and could even serve to create a better offering in certain malls.

In summary, our outlook on the local listed property sector as a whole will be impacted by two main drivers, namely:

- How long economies are shut down to curtail the spread of the virus as this brings into question tenants’ ability to pay rent in the near term, and

- When economies do reopen, how quickly these economies can recover and grow.

Due to the nature of public markets there is the likelihood of short-term volatility in the price of listed equities. It is therefore sensible to have a medium- to high-risk appetite and a long-term view. However, due to the recent drawdown, the SA listed property sector screens as attractive as the annualised sector return is expected to be between 19% and 23% over the long term. It is difficult to call the bottom of any market and we expect continued volatility in the short to medium term as government and private sector navigate through the impact of COVID-19 on the economy and their respective businesses. With low growth prospects for the SA economy and the weak rand, many investors may want to consider investing in listed property offshore.

Listed property outlook: global

During this uncertain time, it is important to review your overall portfolio by understanding how global property functions alongside your local property exposure and your total global allocation. Global listed property has delivered attractive risk-adjusted total returns over the long term relative to the other mainstream asset classes.

Chart 2: Historical returns of main asset classes over short and long term

Source: Catalyst Fund Managers & Bloomberg | Data up to 31 March 2020

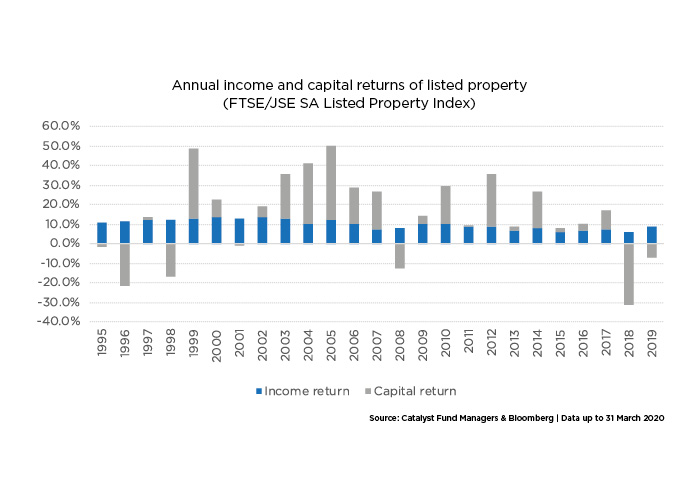

Global listed property also plays an important role in moderate to aggressive global balanced portfolio constructs. This is mainly due to its higher expected return at higher levels of volatility. We can go further, however, and analyse its inclusion from the perspective of three economic regimes: risk-off (i.e. highly volatile environment and hence asset allocations are away from risky assets), risk-neutral and risk-on (quiet periods where we can necessarily take more risks).

Table 1: Global balanced asset allocation model in different environments

Source: Sanlam Investments

Source: Sanlam Investments

From our analysis (finding the optimal portfolio along the efficient frontier), the best time to include Global REITs is in a risk-on environment as this asset class exhibits the highest levels of diversification during this period. Thus, Global REITs add a complementary effect, owing to lower correlations to global equities in this environment, although the implications are that lower levels of return are expected in this environment than, say, relative to global equities.

The risk-neutral environment favours the strongest growth period for Global REITs and an argument could be made for its inclusion as a substitution effect in this environment, i.e. it provides a higher return than similarly volatile assets such as global equities. In such highly volatile times, the better assets would be those that offer lower levels of volatility, such as cash and bonds.

To summarise, when considering your exposure to global REITs, the most optimal environment for including this asset is:

- within a risk-on environment, on the basis of diversification, and

- within a risk-neutral environment, on the basis of growth.

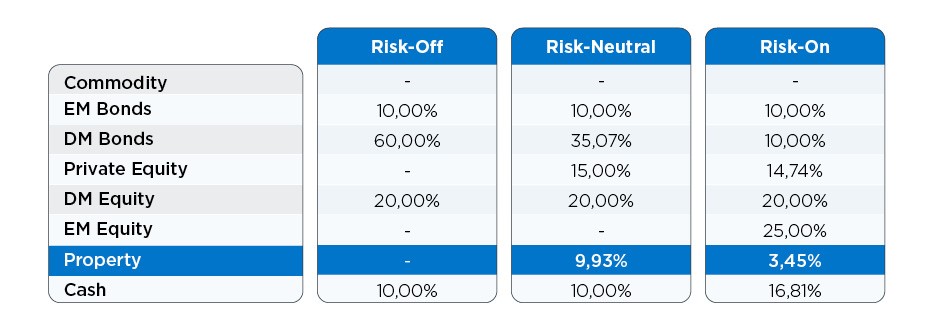

Global REIT investors get exposure to a broad range of sub-sectors, including retail, residential, office, industrial, data centres, golf courses, cellular towers, and self-storage facilities. The COVID-19 impact on various real estate sectors is vast, ranging from being net beneficiaries, to being severely impacted. We believe our tried and tested, risk-adjusted investment methodology will continue to afford us opportunities to identify value in this space, as has been evidenced by our outperformance of the benchmark by around 6.7% year to date.

Our typical global listed real estate fund’s exposure allows investors access to the exciting opportunities presented in a wider range of sectors.

Chart 3: Typical global listed real estate exposure

Source: Catalyst Fund Managers | Data up to 31 March 2020

Source: Catalyst Fund Managers | Data up to 31 March 2020

Global property has indeed been impacted by the COVID-19 pandemic, but we are confident of a global property recovery based on a few key factors:

- Within global property, there are sub-categories or sectors which are less impacted by the COVID-19 shutdown. Some of the niche sectors like data centres have actually benefitted from the COVID-19 pandemic. Other sectors such as residential will be less impacted when it comes to rent collection (and therefore potential dividend haircuts). For example, while it is still early days and metrics will no doubt deteriorate over the coming months, for the month of April we have seen relatively good rent collections across the residential sub-sectors within the US. AMH US (single family stock) reported that as at 9 April, they had collected 86% of April rentals (which is more than 95% of their usual collections amount at this time of the month). EQR US (apartment stock) announced they had collected 93% of their rent roll as at 7 April. This compares to some offshore retail names which are collecting as little as 10% to 20% of rent roll. The SA listed property space has, in stark contrast, very limited sub-sector exposure. Most of the SA listed companies are diversified rather than specialised in one sub-sector. Retail is the largest sub-sector in the SA listed property sector, so most companies will have exposure. Retail sales in malls are already impacted negatively and closure of non-essential services within malls will have a materially negative impact on mall owners over the short term due to the hard lockdown. We went into the crisis overweight good quality retail. We have revisited and revised the assumptions for our entire universe and are reducing exposure to companies that we think will have the highest risk of potential capital raises or breaching of debt covenants. Some of these are retail focused companies. However, based on what we know today, our SA model portfolio still has an overweight exposure to retail due to market mispricing. Complementary exposure to a global variant can address these issues.

- From a fundamentals and balance sheet perspective, global REITs went into this crisis in a better position than before the Global Financial Crisis (GFC) of 2008-2009 (around 30% LTV vs around 44% going into GFC – see graph below). Secondly, from a portfolio perspective, most global REITs have been selling off their weaker quality assets since the GFC, thereby resulting in much higher quality portfolios going into this crisis.

- Certain offshore countries (e.g. the US) have a lot more firepower to pump stimulus into the economy to kickstart economic growth when things normalise. Within the local market, stimulus measures are more limited or muted, especially with the recent downgrade which would be a further headwind to government, incurring additional debt to fund stimulus.

Our global portfolio, not only in times of crisis, will comprise of stocks with solid capital structures, higher quality assets, and management teams with track records of making good capital allocation decisions. We expect the global listed property market to deliver healthy US dollar returns of 8-9% per annum over the medium to long term, while short-term performance could differ materially to the upside or downside. We do see greater value in our portfolio of stocks.

Comments are closed.