Tax relief and your RA

Doing good may be reward enough, but we don’t know anyone who’s declined a reward from SARS for making a contribution to society. Part of the role of government is to promote positive and responsible behaviour among its citizens. That’s why the SA Income Tax Act provides tax relief on those expenses that society would like to see more of.

For example, you can donate up to 10% of your taxable income to any of a wide range of approved public benefit organisations, and see your tax bill reduced. Also, tax rebates are in place for the paying members of a medical aid, as government wants to reward you for taking care of your and your family’s health so no one becomes a burden on the state.

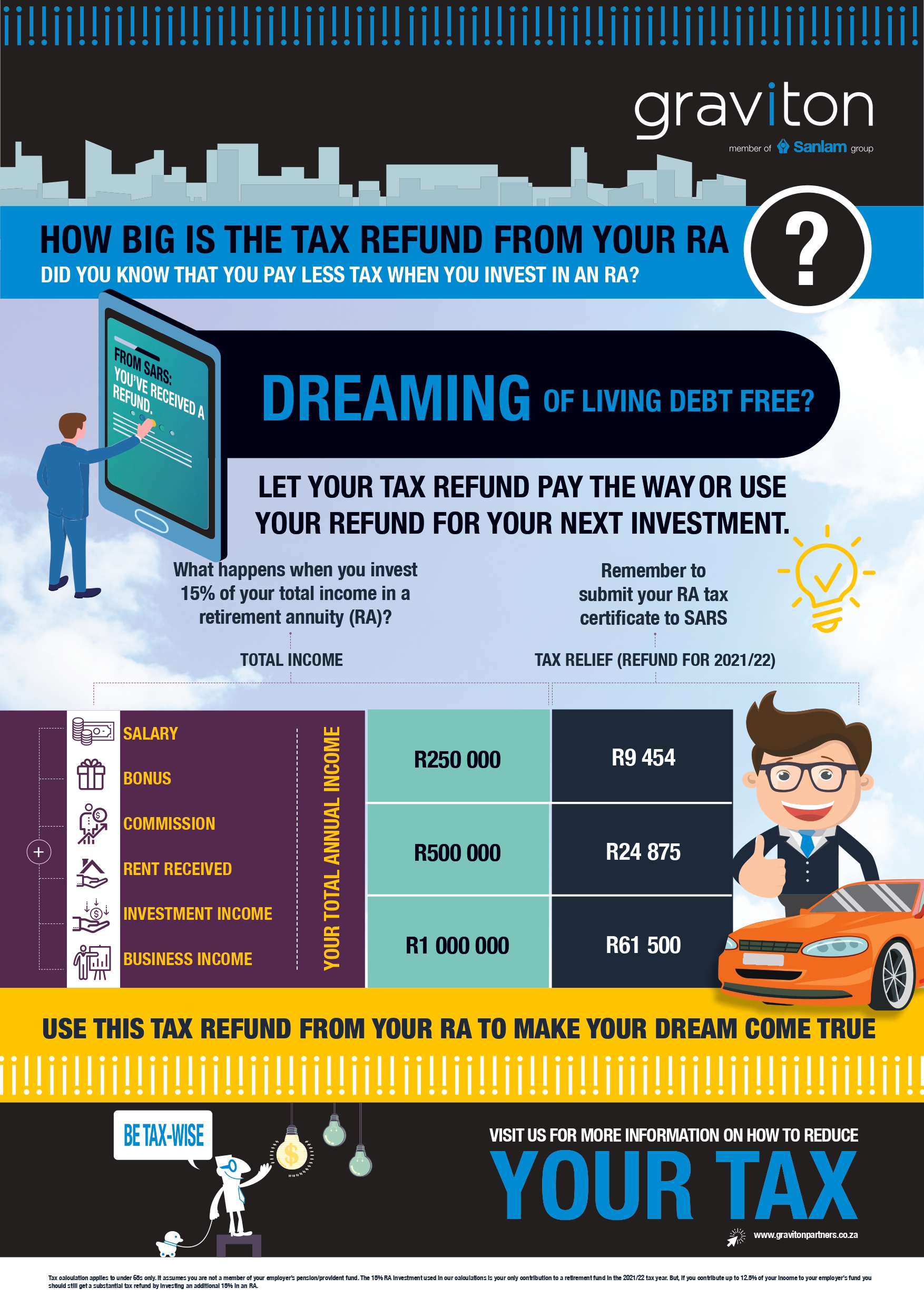

Likewise, SARS rewards you for contributing to a retirement fund now so your older self does not become dependent on the state – or society – in retirement. Therefore, since 2016 you can contribute up to 27.5% of your total annual income to a retirement fund (the contribution is capped at R350 000) and pay significantly less tax.

An RA has several other benefits too: no tax on interest, dividends or capital gains while you remain invested; protection against creditors; and protection against yourself (you can’t touch the money until age 55) – to name but a few. A new-generation RA also allows you to stop your contributions at any time and take it up again at a later stage. We’ve created an RA infographic to show all the main tax and other rules of an RA, but in this article we’ll focus only on the aspect of an RA that we receive the most questions on: how does the tax relief on contributions to an RA work?

We’ll show you here with a few examples how your RA contributions affect your annual tax bill.

A few examples of how an RA provides tax relief

To keep the calculations simple and to focus solely on the tax relief offered by saving for retirement, we assume in all three examples that you had no other tax-deductible expenses, such as medical aid premiums, and made no donations to public benefit organisations. We also assume that you are younger than 65. After age 65 you enjoy higher tax rebates.

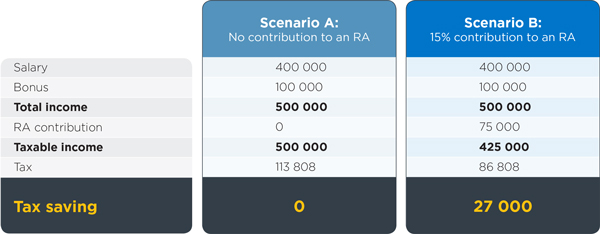

Example 1: You earn R500 000 and contribute 15% to an RA

Using the SARS 2018/19 tax tables and current primary rebate of R14 067, we calculate that you would have paid income tax of R113 808 if you didn’t contribute any amounts to a retirement fund. However, your 15% contribution to an RA (0.15 x 500 000 = 75 000) reduce your taxable income from R500 000 to R425 000. As a result, you need to pay income tax of only R86 808, not R113 808. This means, if you earned R500 000 during this tax year, your 15% contribution to an RA saves you R113 808 – 86 808 = R27 000 in tax!

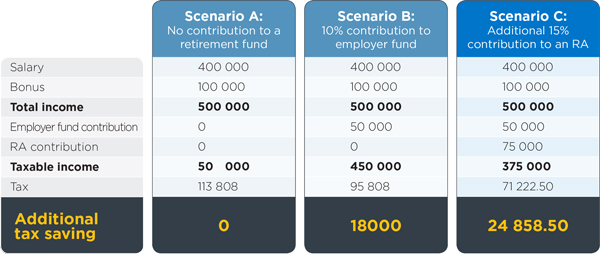

Example 2: You earn R500 000 and contribute 10% to your employer fund and 15% to an RA

If you earned R500 000 in the 2018/19 tax year and you’re already contributing 10% to your employer’s retirement fund, adding another 15% to an RA will lead to a meaningful additional tax saving.

Again, using the SARS 2018/19 tax tables, we calculate that you would have paid income tax of R95 808 if you contributed 10% to your employer fund only. Your additional 15% contribution to an RA (0.15 x 500 000 = 75 000) reduce your taxable income from R450 000 to R375 000. As a result, you need to pay income tax of only 71 222.50, not R95 808. This means your 15% contribution to an RA saves you an additional R95 808 – 71 222.50 = R24 858.50 in tax.

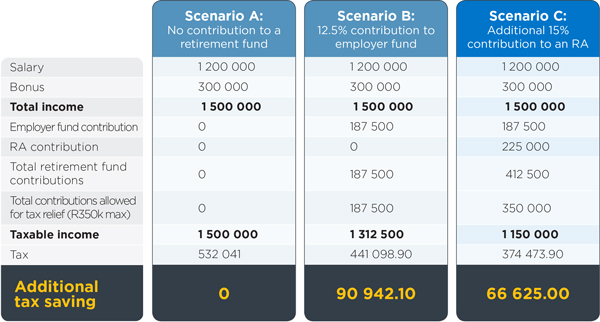

Example 3: You earn R1.5m and contribute 12.5% to your employer fund and 15% to an RA

The calculation becomes a little more tricky if you’re a high-income earner contributing the full 27.5% to retirement funds. This is because SARS does not allow you to deduct retirement contributions of more than R350 000 per tax year. So, if you, for example, earned R1 500 000 in the 2018/19 tax year and want to contribute 27.5% in total to your employer fund and RA combined (27.5% = R412 500), the deductible amount needs to be capped at R350 000 as shown in the last column of the table below. Still, even with this constraint in place, your 15% RA contribution saves you an additional R66 625 in tax.

We’ve captured the impact of the tax relief from an RA in the infographic below.

Remember to submit your RA certificate

Keep in mind that SARS can only provide you with a refund or lower tax bill if it knows about your RA contributions. Therefore, keep your RA tax certificate in a safe place and remember to enter the total contributions for the tax year when completing your tax return (the 2018/19 filing season opens on 1 July 2019). SARS will also ask you to submit your RA tax certificate along with the rest of your supporting tax documents.

Two weeks left of this tax year

By the second week of February every year you should have a fairly good idea of what your total income – salary, business income, interest, rental income, bonus and included capital gain for the current tax year will be. If you add all these figures up, you can contribute 27.5% (capped at R350 000) of the total to your employer’s fund and your personal RA combined. If you haven’t used the full allowance yet, it’s possible to top up your RA with most administrators within a matter of days. Even if you don’t have the means to contribute the full 27.5% yet, every bit of tax relief helps. May you be rewarded not only with a lower tax bill this year, but with the type of retirement you can look forward to.

Comments are closed.