February – make or break for your tax plan

But should you go for an RA or a tax-free savings account?

Taking stock of your finances at the start of February can make or break your tax plan for the year ending 28 February. Now is the ideal time to spot the gaps where you haven’t yet fully used all of your tax-free allowances, whether it’s via a retirement annuity (RA) or a tax-free savings account (TFSA).

Option 1 – max out your TFSA

February is a good time to log into all your tax-free savings accounts and double-check how much you’ve contributed in total since 1 March last year. Are you still under the R33 000 annual contribution limit across all accounts? Great, there’s a gap for you. Do you have spare cash to invest? If not, do you have any investments in taxable products, such as standard (pre-TFSA) unit trusts? You may want to consider converting some of that investment (if no penalties apply) and investing the money in a TFSA version of the same unit trust instead. To do that, you would need to withdraw money from your existing taxable unit trust to reinvest into your TFSA. Remember that the withdrawal would trigger a capital gain with SARS, but the first R40 000 of your taxable gains every tax year is currently exempt from capital gains tax.

Option 2 – top up your RA

By the start of February you should have a fairly good idea of what your total income – salary, business income, interest, rental income, bonus and included capital gain for the current tax year will be. If you add all those figures up, you can contribute 27.5% (capped at R350 000) of the sum to a retirement fund and enjoy tax relief. A retirement fund can be your employer’s fund or your personal RA. If you haven’t used the full allowance yet, do you have any spare cash to make a lump sum contribution to your RA before 28 February?

Like many South Africans, you may only have enough cash for one of the above options, not both. How would you choose between a TFSA and an RA?

If you need the money before age 55, don’t use only an RA

If you’re one of the fortunate (and diligent) people who can afford to save a substantial chunk of your income every month because you plan to be financially free before the age of 55, then putting more money into an RA may not appeal to you. That is because, under current laws, the earliest date that you may withdraw money from an RA is age 55, and on your retirement date your withdrawal is limited to a lump sum of only one-third of the value of your RA.

If you plan to ‘retire’ early, don’t disregard an RA completely, though. It’s possible to use both a TFSA and an RA as long-term savings products. Once you’ve reached your financial freedom goal you could use your TFSA to withdraw the money needed to survive up to age 55, or longer if it lasts. After age 55 you can officially retire with your RA and use the one-third lump on retirement and subsequent annuity income to live from.

You can only invest R33 000 per year in a TFSA

Currently you may invest up to R33 000 per tax year in a TFSA. Any additional contributions are taxed at a heavy 40% of the excess above the R33 000 limit. In contrast, there’s no limit on contributions to a retirement product, such as an RA, pension or provident fund. You can invest as much of your income as you please, although only the first 27.5% – capped at R350 000 – is tax-deductible. There’s nothing stopping you from exceeding this limit. You will not be hit with a tax penalty; a tax penalty only applies to excess contributions to a TFSA .

With an RA you pay tax in retirement

A great benefit of both a tax-free investment account and a retirement annuity (RA) is that all the growth and income of the investment are tax-free while you remain invested. This includes tax on interest, dividends and capital growth.

However, an important difference between a TFSA and an RA is that, with a TFSA you pay no tax on withdrawals.

With an RA, only the first R500 000 of your lump sum taken at retirement is tax-free. When you start withdrawing an annuity income, that income is taxable as per the normal income tax tables of the South African Revenue Service (SARS). It’s therefore more accurate to call it a ‘tax-deferred’ investment instead of a tax-free investment. However, for most high-income investors, the income tax rate in active employment is higher than when drawing a retirement income in the future. For example, you might be getting a 41% tax relief now if you’re earning more than R708 310 per year, but your retirement income might only be in the 36% or 31% tax bracket one day when you retire. This makes deferring your tax by contributing to an RA in your higher-earning years worth it. And, on top of that all the income and growth earned within the RA before you retire is tax-free.

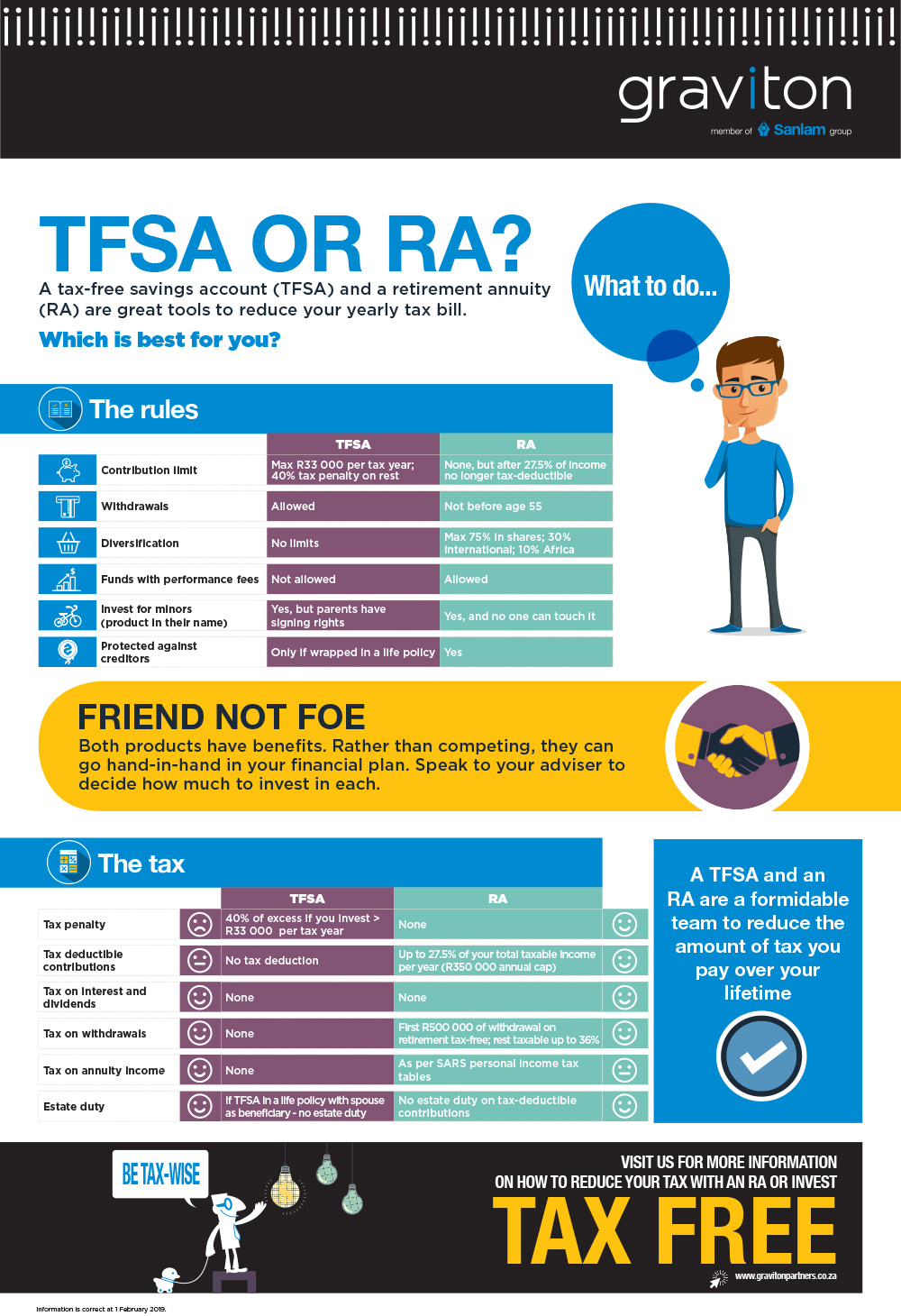

Gravtiton has created an RA infographic to view the main tax and other rules of an RA at a glance.

Our TFSA vs RA infographic makes it easy to compare

We’ve highlighted the main differences between a TFSA and an RA above. There are many other differences – relating to the types of funds they may invest in, rules around protection from creditors, estate duty, and parents’ rights on an RA or TFSA held in a minor’s name.

To help you compare these products at a glance, Graviton has created an infographic.

So, should you go for an RA or a TFSA? That will entirely depend on your unique tax bracket – now and once you are ‘retired’. It will also depend on whether you would need access to your savings before age 55, whether you want to invest 100% in shares, property or offshore assets (not allowed with an RA) and whether you need protection against potential future claims from creditors.

Your needs are unique and therefore how much you need to allocate to your RA compared to your TFSA will vary from person to person. We highly recommend that you speak to a financial adviser to make sure you grow your money in the products that are most likely to meet your future income needs.

Comments are closed.