May 2022 Economic Review

Introduction

Global markets experienced another volatile month in May, with the most extreme swings in recent memory as nearly all asset classes witnessed significant selling in the first half of the month, and bounced back in the last week as investors bought the dip, before ending the month on a subtle note. South Africa ended the month relatively unchanged. Investor sentiment once again was weighed down by rising interest rates, the ongoing Russian invasion of Ukraine, and soaring inflation. Furthermore, concerns over a possible US recession later this year contributed to the bleak sentiment.

US showing signs of slowdown, inflation remains in the spotlight

US consumer inflation fell to 8.3% year-on-year (y/y) in April, compared to 8.5% y/y in March. Despite the fall, inflation remains much higher than the 2% target and combined with the tight labour market gives the US Federal Reserve (Fed) room for more interest rate hikes. The Fed in its monthly meeting, called inflation a serious concern and stated, as expected, that most participants backed two 50-basis point rate hikes at the June and July meetings.

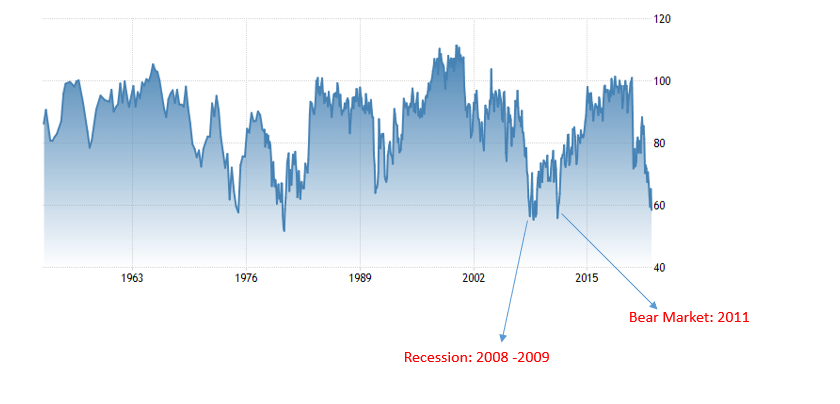

The US is beginning to show signs of a slowdown, as the ISM Manufacturing Purchasing Managers Index (PMI) fell for the second consecutive month to 55.4 in April compared to 57.1 in March. The result marked the weakest level since July 2020. The University of Michigan consumer sentiment for the US was revised down to 58.4 for the month of May, the lowest reading since August 2011 and consistent with previous levels of the recession experienced in 2008.

Graph 1: US Consumer Sentiment

Source: Trading Economics, 2022

On a positive note, the pace at which the US continues to add jobs is bewildering and continues to contribute to an already tight labour market. The US economy added 428 000 jobs in April, the 12th consecutive month they managed to add above 400 000 jobs.

Eurozone inflation hits record numbers

The eurozone inflation reached a much higher than expected 8.1% y/y in May compared to April’s 7.4% print. This was the 11th consecutive rise in inflation for the region and the highest since records began in 1997. The conflict in Ukraine continued with no signs of a near-term resolution – while there have been calls for a diplomatic solution the current red lines laid out by both sides seem incompatible. As a result, energy and commodity prices soared and added to global supply chain issues. On a country level, France’s May inflation and Germany’s preliminary inflation hit fresh records, reaching 5.8% and 7.9% y/y respectively.

China announces easing of lockdown restrictions

China continued to grapple with the Omicron variant, as Shanghai spent most of May in lockdown, though as the month progressed, some reopening occurred. The country’s zero-Covid strategy has been weighing on markets, thus the government’s announcement to ease restrictions later in the month brought some relief to the country’s economic outlook.

In terms of economic data, following two months of contraction, China’s official Manufacturing PMI rose to 49.6 in May. The 50-point mark separates expansion from contraction, showing China is on its way to recovery in economic activity following the lockdowns experienced for the last three months.

Chinese credit growth slowed during May, as banks concerned about the worsening economic situation cut back on loan issuance. In response, the People’s Bank of China (PBOC) placed pressure on banks to increase loan issuance and cut a key mortgage reference rate by 15 basis points to support house prices. The PBOC stated in May it would step up support for the country’s slowing economy, while closely watching domestic inflation and monitoring policy adjustments by key developed nations.

UK inflation hits 40-year high

April UK inflation reached a 40-year high of 9% y/y (7% y/y in March) on the back of soaring gas and electricity costs. The Bank of England (BoE) now expects UK inflation to rise around 10% in 2022. In an attempt to tame inflation, the BoE followed developed counterparts and hiked rates by 25 basis points to a 13-year high of 1% during their monthly meeting in May.

The recent dip seems to be spreading to other asset prices

Cryptocurrencies experienced a fall in May. Most noticeably, stable coin TerraUSD collapsed almost to zero, wiping out US$18 billion of value in the crypto asset. Bitcoin fell around 17% month-on-month (m/m) in price.

South Africa

In local economic data, April’s annual headline inflation measured by the consumer price index (CPI) was unchanged from March at 5.9% y/y. According to Stats SA the key drivers were once again food and non-alcoholic beverages, housing and utilities, as well as transport. As expected, and largely already priced into the market, the South African Reserve Bank (SARB) hiked rates by 50 basis points during May. Furthermore, Standard & Poor’s (S&P) upgraded SA’s credit rating outlook to positive from stable.

Retail sales rose 1.30% y/y in March, less than market estimates of a 1.50% y/y increase. The largest positive annual growth rates were recorded for sales of pharmaceuticals and medical goods.

The latest Quarterly Labour Force Survey (QLFS) was released on 31 May, showing the country’s unemployment rate declined slightly in the first quarter of 2022 to 34.5% from 35.3% in the fourth quarter of 2021. This marked the first decline in seven quarters as the manufacturing and mining industries added jobs to meet the demand for commodities. In summary, there are 7.9 million unemployed people in the country as at the first quarter of 2022, with 370 000 jobs gained quarter-on-quarter.

Global markets

Despite a rally in the last few days of the month, developed equity markets ended the month in the ‘red’ once again. The MSCI World Index closed 0.16% down m/m in US dollar and 1.63% down m/m in rand. However, most major developed market equity indices managed to end the month higher. The S&P 500 snapped its seven-week losing streak during the month and closed 0.18% up m/m, despite another poor month for the tech-heavy Nasdaq 100 Index (around -1.5% m/m). The UK’s blue-chip FTSE (£) rose for the second consecutive month, closing at 0.69%. The EuroStoxx 50 (€) returned 1.34% m/m.

Emerging equity markets fared slightly better than their developed counterparts for the second consecutive month, the MSCI Emerging Markets Index closing 0.14% up in US dollar and 1.33% down in rand. China and Brazil led the way. The Brazilian stock market benefited from large exposure to energy counters, which rallied along with the price of Brent crude oil (around 12% m/m). Signs of restriction easing in China late in the month and the government’s promise to implement various economic support measures, pushed the Shanghai Composite higher m/m.

Local markets

The South African equity market eked out a tiny loss, but bounced back from April’s wobble. The FTSE/JSE All Share Index closed 0.36% down m/m, its second consecutive month down. Local banks were among the best performers.

On a sector level, Financials was the only sector to finish in positive territory, 0.15% up m/m. Resources and Industrials lagged, closing 0.32% and 2.35% down m/m respectively. Gold miners were among the worst performers, dragged down with the gold price. Local bonds got back to winning ways, the All Bond Index (ALBI) returning 1.01% m/m. SA listed property gained slightly, 0.05% m/m. Cash (STeFI) increased with rate hikes, delivering a moderate return of 0.39% m/m. South African value managers (+2.25% m/m) outperformed growth managers (-3.08% m/m) once again, as the gap continues to grow both locally and globally.

The rand experienced another volatile month. Interest rate hikes by the Fed resulted in a mid-month high of R16.32 against the US dollar, however, the SARB’s rate hike subsequently pushed the rand back below the psychological level of R16. The rand ended the month 1.49% and 1.11% up against the dollar and pound. The rand lost as much as 0.05% and 0.71% against the euro and Japanese yen.

Comments are closed.