January 2024 Economic Review

January Economic Review

At the start of 2024, the recovery in the global economy continued to be evident, although it was generally uneven across different regions. The International Monetary Fund (IMF) has projected a soft landing, reiterating the lagged effects of monetary policy tightening and a strong disinflation trend. The US economy performed strongly in the fourth quarter of 2023: Gross Domestic Product (GDP) increased at an annualised rate of 3.3% compared with an increase of 4.9% in the third quarter of 2023.

In January, five of the central banks overseeing the 10 most heavily-traded currencies – the US Federal Reserve (US Fed), the European Central Bank (ECB), the Bank of Japan, Bank of Canada and Norges Bank – held rate setting meetings. None of them changed rates. In SA, the Reserve Bank’s Monetary Policy Committee (MPC), in its first meeting for the year, unanimously voted for an interest rate pause. Although South African consumers are feeling the impact of “higher-for-longer” interest rates, economists expect rates to be on hold until the second half of the year, and then cuts will begin.

Global economy approaches soft landing, but risks are involved

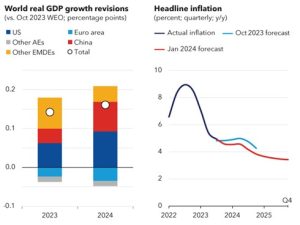

The IMF has projected a soft landing for the global economy, upwardly revising its forecast for global growth and downwardly revising its inflation forecast. According to the January IMF World Economic Outlook, global growth is projected at 3.1% in 2024 and 3.2% in 2025. The latest 2024 forecast is 0.2% higher than the IMF projected in October 2023. Growth is mainly driven by the unexpected resilience of the US economy and several large emerging market and developed market economies, as well as fiscal support in China.

The pace of growth in the US, however, is expected to be slow, as tight monetary policy works through the economy. The US Fed, ECB and Bank of England are expected to cut interest rates in the second half of the year as they try to avoid undermining growth. While inflation has been trending towards central banks’ respective targets, cutting interest rates too early or aggressively may increase the risk of prolonging inflation. In China, weaker consumption and investment continue to weigh on activity. In the euro area, activity is expected to rebound slightly after a challenging 2023 when high energy prices and tight monetary policy restricted demand. Many other economies continue to show great resilience, with growth accelerating in Brazil, India, and Southeast Asia’s major economies.

The chart on the right below shows that global inflation is projected to ease in coming years. In January, the IMF projected that global headline inflation would decline to 4.9% in 2024, a 400 bps revision from its October 2023 projection of 4.5% (excluding Argentina). It sees core inflation (which excludes volatile food and energy prices) also trending lower. Moreover, the IMF projects headline and core inflation to average around 2.6% in 2024 in advanced economies.

Source: IMF, World Economic Outlook, January 2024

US economy delivers a strong Q4 performance

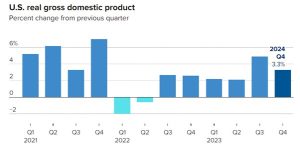

The US economy keeps progressing and proving many market forecasters – especially those anticipating it would experience a recession – wrong. Economists previously estimated it would contract by 0.1%, but it recovered quickly, beating expectations. The economy delivered a strong performance in the fourth quarter of 2023, when GDP increased at an annualised rate of 3.3% from a previous increase of 4.9% in the third quarter of 2023.

The overall economic growth for 2023 was 2.5%, well ahead of Wall Street’s expectation of a recession at the beginning of the year and better than the 1.9% growth rate in 2022. The recession outlook was supported by the US Fed’s rapid moves to hike interest rates to fight inflation, raise borrowing costs for businesses that were already struggling. Apart from strong GDP growth, the US core inflation rate rose 2% and the headline inflation rate was 1.7% for the period. The biggest contributors to the growth were consumer spending, which rose by 2.8%, state and local government spending (up 3.7%), federal government spending (up 2.5%), and gross private domestic investment (up 2.1%) for the quarter.

Source: US Bureau of Economic Analysis, January 2024

For your interest

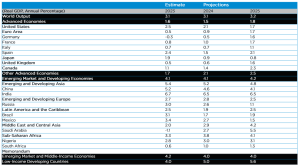

1.World Economic Outlook growth projections for 2024 and 2025

(Source: IMF, World Economic Outlook Update, January 2024)

2. Attacks in the Red Sea:

- Since 7 October 2023, Houthi militants in Yemen have been targeting commercial cargo ships in the Red Sea, severely disrupting maritime trade. These attacks have forced ocean carriers like MSC and Hapag-Lloyd to re-route shipments away from the Red Sea.

- Ships diverted from the Suez Canal will be forced to go around the Cape of Good Hope, much like trade did before the Suez Canal existed. This longer journey increases fuel costs, reduces shipping efficiencies, and could raise the prices of imported goods, including critical shipments of grain from Asia and oil from the Middle East. (Source: Visual Capitalist, December 2023)

3. Major central banks pause interest rates:

- In January, five of the central banks overseeing the 10 most heavily-traded currencies – the US Fed, ECB, Bank of Japan, Bank of Canada and Norges Bank – held rate setting meetings, when none changed rates. That follows eight meetings in December, when only Norway hiked. (Source: Reuters, January 2024)

4. US jobless claims:

- The US Labour Department said initial claims for state unemployment benefits rose by 9 000 to a seasonally-adjusted 224 000 for the week ending 27 January 2024, the highest level since November 2023.

- Despite the rise in claims, most employers are holding onto workers after difficulties sourcing labour during and after the Covid-19 pandemic. But some companies, which enjoyed a boom in business during the pandemic, are laying off workers as conditions revert to normal. (Source: Reuters, January 2024)

5. Evergrande ordered to liquidate:

- A Hong Kong court ordered the liquidation of Chinese property developer, Evergrande Group, dealing a fresh blow to confidence in the country’s fragile property market, as policymakers step up efforts to contain a deepening crisis.

- High Court Justice Linda Chan decided to liquidate the world’s most indebted developer, which has more than US$300 billion of total liabilities, after noting Evergrande has been unable to offer a concrete restructuring plan more than two years after defaulting on its offshore debt and following several court hearings.

- China will now be forced to absorb the liabilities of any large company failures – such as Evergrande – in the property sector to protect against wider contagion. (Source: CNBC, January 2024)

6. Eurozone business activity contracts for eighth month

- A survey showed a contraction in business activity in the Eurozone due to falling demand and rising price pressures resulting from tensions in the Red Sea. The manufacturing outlook improved but remained in contractionary territory. It was partly offset by a steeper decline in the bloc’s services industry.

- There was evidence of inflation creeping back up, with both input and output price indices rising. The output prices index rose to 54.2 from 53.8, its highest level since May 2023. That is likely to disappoint policymakers at the ECB, who are keen to get inflation back to their 2% target. However, optimism about the year ahead improved and the business expectations index jumped to 59.8 from 58.3. The last time it was this high was in May 2023. (Source: BusinessDay, January 2024)

Growth expectations for the South African economy

At the MPC’s first meeting for the year in January, South African Reserve Bank (SARB) officials unanimously voted for interest rates to remain at current levels. Although South African consumers are feeling the impact of the “higher-for-longer” interest rates, economists expect rates to remain paused and cuts to only be made in the second half of the year. The SARB Governor, Lesetja Kganyago, said there were serious upside risks to inflation due to local challenges and geopolitical uncertainty, which will have implications for the rand and supply chains. He said the economic outlook was highly uncertain. The MPC said that the deterioration in the performance of South African ports, Transnet’s failures and lengthy periods of power cuts, which have persisted into the new year, have constrained the local economy.

Although SA faces numerous economic challenges, the SARB expects the local economy to grow 1.2% in 2024 and 1.3% in 2025. On another positive note, the SARB expects electricity supply to increase gradually over the long term, due to the rapid uptake of alternative energy sources by the private sector. Kganyago warned that global economic conditions were deteriorating, and the outlook remained uncertain. Global shocks would negatively impact the South African economy and inflation. In most countries, reaching inflation targets, reducing fiscal deficits, and containing or lowering public debt levels will be key priorities.

Market overview

Global markets

The year started on a generally positive note for investors, with the MSCI World Index ending the month up 1.2% in dollar terms. Although there was some optimism, global bonds ended negatively at -1.38% m/m and global property was also in negative territory at 3.99% m/m (both in dollars). Emerging markets were negative for the month: the MSCI Emerging Markets Index ended at -4.64% (in dollars). The Dow Jones was in positive territory at 1.31% m/m and the S&P 500 at 1.68% m/m (both in dollars), the EuroStoxx Index ended at 2.97% m/m in euros and the Nikkei at 8.44% m/m in yen. The FTSE 100 Index ended the month at -1.32% in pounds but the DAX gained 0.91% in euros.

Local markets

South African stocks experienced a tough start of the year, with the All-Share Index ending the month at -2.93% in rands. The derivatives market underperformed for the month, with Resources ending at -6.31% m/m, Industrials at -4.32% m/m and Financials at -3.17% m/m. Cash was positive, with the STeFI ending at 0.7% m/m in rands. Bonds ended in positive territory for the month, boosting the credit market. The All-Bond Index ended at 0.71% m/m in rands, with bonds of 1-3 years at 0.78% m/m, bonds of 3-7 years at 0.83% m/m, bonds of 7-12 years at 0.69% m/m and bonds of over 12 years at 0.65% m/m. The rand weakened against several currencies: against the US dollar by -1.67% m/m, the euro by -0.01% m/m, and the pound at -1.57% m/m. However, it strengthened by 3.68% against the yen.

Comments are closed.