Using your tax refund to bring home more refunds?

Let’s be honest. It’s seldom with great excitement that we open a message from the taxman. But this time of the year that short note announcing a refund to investors who’ve topped up their retirement annuities in the previous tax year is most welcome. Which brings us to the question: what should you do with your refund?

Most likely some of it needs to go towards childrens’ school fees, your bond or some urgent home repairs, but we hope you also reward yourself for putting away extra money last year by enjoying some of it now. Investing in memories is important, as your older self will need both memorable moments to relive with friends and family – and enough money to retire with dignity.

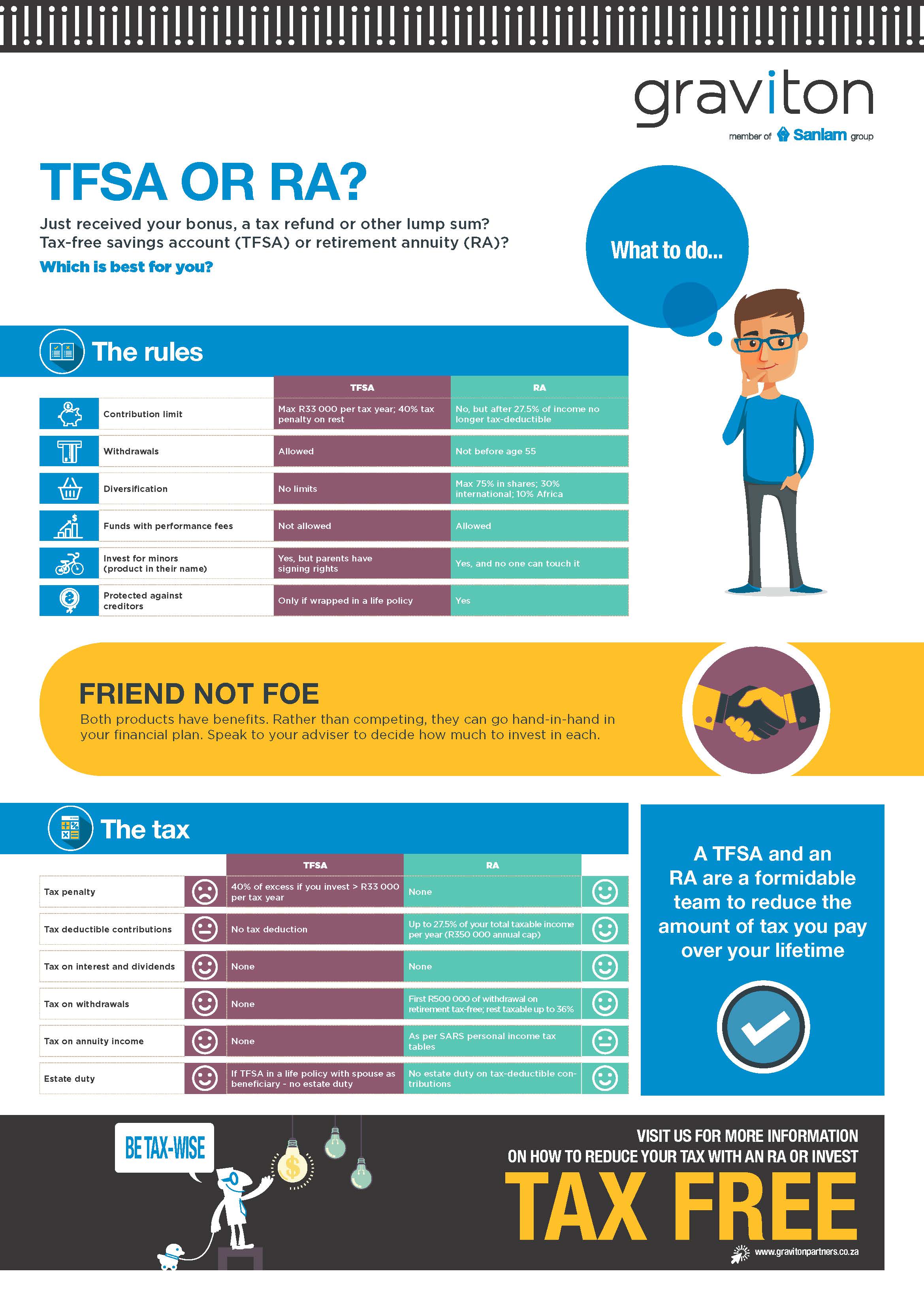

To make sure you achieve the latter, we recommend that you use at least part of your tax refund for your long-term savings. In most cases a tax-free savings/investment account (TFSA) or retirement annuity (RA) is the tax-efficient choice, as you pay no tax on income or capital growth on your investment while it remains invested.

But which one – TFSA or RA – is a better fit for you?

If you plan to ‘retire’ early, don’t disregard an RA completely, though. It’s possible to use both a TFSA and an RA as long-term savings products. Once you’ve reached your financial freedom goal you could withdraw the money needed to survive from your TFSA up to age 55, or longer if it lasts, and thereafter ‘convert’ your RA to an annuity income.

If you contributed more than 27.5% of your total taxable income per tax year or more than the annual R350 000 contribution cap to your RA and employer’s fund combined, there is no reason for concern. You will not be hit with a tax penalty; a tax penalty only applies to excess contributions to a TFSA . With an RA, any excess amounts are simply carried over to following tax years until they are all ‘used up’ for tax deductions. And the returns on them are also tax-free while your money stays in the RA.

But, with an RA, the moment you retire from the product and start withdrawing an annuity income, that income is taxable as per the normal income tax tables of the South African Revenue Service (SARS). For most high-income investors, though, their income tax rate while they’re in active employment would likely be higher than when they draw a retirement income one day, making contributions to an RA and the resultant tax relief while they’re still working worth their while.

Unlike the RA, contributing to a TFSA does not give you the chance of getting back a tax refund; contributions are not tax-deductible.

To help you compare these products at a glance, we’ve created an infographic for ease of reference.

Comments are closed.