September 2021 economic review

Economic overview

September was a noisy and brutal month for most global markets, including South Africa. Factors such as Chinese headwinds, less accommodative monetary policy, deepening inflation, concerns of slowing growth, the Covid-19 Delta variant and the possibility of a US government shutdown dampened risk appetite and weighed on investor sentiment for the month, resulting in most major equity markets closing the month in negative territory.

Covid-19 fears, US spending plan divide and poor stock market performance dampen US outlook

The US Federal Reserve (Fed) held its monthly meeting, with the Fed expected to announce tapering at its next meeting in November, with asset purchases set to come to an end around the middle of next year. The release of updated forecasts from the Fed members now shows the median member of the Fed expects rates to begin hiking next year, compared to prior predictions of 2023. The speed of rate increases was faster than the market had been pricing in, resulting in Treasury yields rising in the days following the Fed’s September meeting.

In terms of US economic data, the Conference Board’s Consumer Confidence Index recorded its third straight monthly decline in September, and a seven-month low. This was on the back of a continued increase in Covid-19 cases due to the highly contagious Delta variant, which deepened concerns about the US economy’s near-term prospects.

With a divided Congress, neither side has come to a spending plan agreement. If Congress fails to meet its deadline to pass annual spending bills, it could result in a US government shutdown. If this happens, it will be the first shutdown during a global pandemic.

On the financial markets front, banking analysts in the US predict that the stock market performance could potentially worsen, amid concerns over the market’s vulnerability.

UK eases visa rules to attract lorry drivers amid petrol distribution issues

The Bank of England (BOE) delivered a hawkish shift similar to the Fed, announcing rates could increase before the end of the year. As a result, UK government bond yields moved higher, reversing the rally from earlier in the quarter.

The UK government is poised to temporarily ease visa rules to attract more foreign lorry drivers, following the growing shortage in fuel supplies the country has faced over the past weeks. The lack of drivers led to huge queues at petrol stations, as people ignored government requests not to panic buy after some petrol stations closed due to lack of deliveries. As a result, the army has been put on standby to deal with the panic of buying fuel. The Covid-19 pandemic, Brexit and tax changes have all contributed to the lack of qualified drivers. The government further stressed there is no actual shortage of petrol in the UK, but problems with distributing to petrol stations.

Supply-chain shortages result in Eurozone economic slowdown for second consecutive month

The European Central Bank (ECB) announced a reduction in the pace of its asset purchases, but in contrast to the Fed, emphasised this was not the beginning of a process of tapering purchases down to zero. The ECB seems to be left behind on the Fed and BOE’s path to higher rates.

Eurozone economic growth slowed for a second consecutive month in September, as supply-chain shortages affected both the manufacturing and service sector.

The German elections were concluded in September, with centre-left Social Democrats (SPD) claiming victory in the federal election. The election also brought the close of the Angela Merkel era, who served 16 years as chancellor for the Christian Democratic Union (CPD).

China’s economic woes continue

China is now facing a power crisis as manufacturers seek to meet the demand for year-end shopping. This led to the country facing power cuts in some of the largest powerhouses, which account for almost a third of the nation’s GDP.

There are several reasons for the energy shortages, but predominantly it’s China’s heavy reliance on coal, more than half of which is imported. The strong recovery in China’s industrial sector since the Covid-19 pandemic has increased demand for energy. The price of coal that can be imported has risen sharply, with China’s power companies’ inability to cover such higher costs and unwillingness to supply power at a loss leading to a cutback on electricity supply. China’s reliance on coal to generate electricity and the goal of achieving net zero emissions in the near future make for a very complex solution.

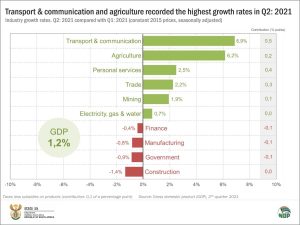

South Africa GDP positive in Q2 2021

South Africa’s second quarter (Q2 2021) GDP printed at 1.2% quarter-on-quarter, according to Statistics SA. Despite recording four consecutive quarters of growth, the SA economy remains 1.4% smaller than it was prior to the pandemic.

Six of the ten industries recorded a rise in production in Q2 2021, with transport and communication, agriculture, personal services and trade industries the most significant drivers of growth in the second quarter.

Source: Statistics SA

On the pandemic front, the country moved to adjusted Level 1 lockdown restrictions on 1 October 2021, as SA continues to experience a decline in daily Covid-19 cases, supported by increased vaccinations. The South African Health Products Authority also recently approved the Pfizer Covid-19 vaccine for 12-year-olds and above.

The South African government was in discussions with the world’s richest countries to discuss a climate deal that could channel R76 billion towards ending the country’s reliance on coal, due to ongoing concerns around global warming and the shifting focus on renewable energy. Coal currently makes up 80% of SA’s power generation.

South Africa remains one of the countries on the UK’s “red list of entry”, which means upon arrival, foreigners would be required to quarantine in hotels at their own cost. This continues to hurt the South African tourism industry and it is estimated the industry loses R26 million each day it remains on the “red list,” according to the CEO of the Tourism Business Council of SA, Tshifhiwa Tshivhengwa. The UK is SA’s biggest source of tourism in the northern hemisphere. The Department of Health confirmed that the UK would consider the data provided by South African government scientists in their next review of its red list.

Market overview

Global markets

Global equity markets experienced their poorest month in some time, as developed equity markets recorded their worst month since March 2020, when the pandemic effect took place. The MSCI World Index closed -4.29% month-on-month (m/m) in USD and -0.45% in ZAR. Announcements from the US Federal Open Market Committee weighed on US equities for the month, with the S&P 500 (US$) down 4.65% m/m. The only S&P 500 sector to end the month higher was the energy sector due to a global shortage of natural gas, which saw natural gas prices spike. US 10-year government bonds gained slightly m/m, with the Fed members seemingly ready to begin tapering quantitative easing before the close of 2021. European equities also closed the month on a negative note, with the Euro Stoxx 50 (€) down 3.37%.

In China, one of the world’s largest property developers, Evergrande, saw its share price fall around 33% m/m, weighing on Chinese equities performance and further dragging emerging markets lower for the month. The MSCI Emerging Market Index returned -4.25% m/m in USD and -0.41% in ZAR. This is despite a positive performance from Indian and Russian stock markets, which benefitted from outsized exposure to energy companies.

Local markets

The South African equity market experienced its second negative month of 2021, as the FTSE/JSE All Share Index closed at -3.14% m/m, with the best performers of the month coming in the form of energy companies, benefitting from the global shortage in energy materials. The domestically focussed shares delivered a small positive contribution for the month, despite the poor performance from the retailers.

All major sectors were in negative territory for September. Resources are down 9.55% m/m, with particularly the mining industry contributing to the significant downfall. Industrials and Financials closed the month at -1.17% and 1.66% respectively. South African government bonds struggled in September amidst a higher global yield environment, returning -2.12% m/m. The SA Reserve Bank (SARB) left repo rates unchanged in its monthly meeting, as anticipated. Cash (STeFI) delivered a moderate return of 0.31% m/m, as expected in the low interest rate environment. South African value managers (-2.67% m/m) outperformed growth managers (-3.38%% m/m).

The ZAR continued to lose ground against the strong USD, closing at -3.86% m/m, hitting a new low in September. Furthermore, the ZAR lost as much as 2.07% and 1.87% against the euro and sterling but managed to finish stronger against the Japanese yen at 1.56%.

Comments are closed.