Positioning to manage risk during an economic and market malaise

This economic environment is one that no one could have seen coming given the current fiscal and monetary conditions.

– Warren Buffett, Berkshire Hathaway shareholders meeting, May 2019 –

What is causing the economic and market malaise?

Geopolitical risk and concerns of a slowing global economy have weighed heavily on global and local equity markets for the last 18 to 24 months. The majority of this started with growing tensions between the US and China and political uncertainty caused by Brexit between the UK and Europe.

The effects of quantitative easing have also become quite apparent with more than $15 trillion of government bonds worldwide trading at negative yields. The increased money supply and low interest rates which were targeted at encouraging additional borrowing by both consumers and businesses has not had the desired effect in spurring business and consumer sentiment and spending.

Additionally, there have been some notable ‘left-field’ events that have caused market jitters. Some of these include:

- Trump’s tariff tweets

- Turkish crisis

- Argentinian bond defaults

- Corporate scandals – Huawei, Facebook

Locally, Eskom remains a hot topic, along with other state-owned enterprises. The poor public finances coupled with concern about the global economy may be keeping business sentiment weak, as evidenced by the contraction in capital investment in 2018.

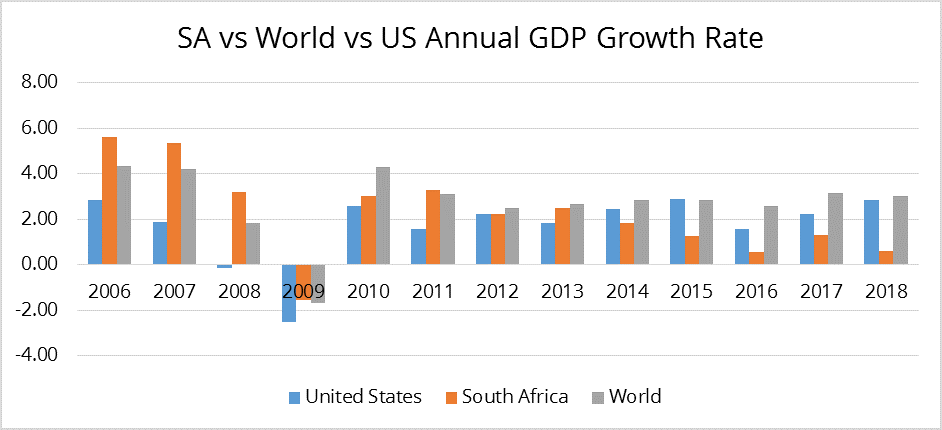

Subsequently, to no surprise South Africa finds itself in quite a precarious position relative to the world’s largest economy (US) and the world economy, which have been averaging 2.5% – 3% growth over the last seven calendar years. SA has been positive but on a steady decline toward 0%.

Source: World Bank

Where are the green shoots?

The South African economy is still experiencing growth, albeit at a slow pace. After shrinking sharply in the first quarter of 2019, the economy rebounded from a low base to record positive growth of 3.1% in the second quarter (April to June). Recently, it was also made public that Moody’s is unlikely to downgrade South Africa from its investment-grade status in 2019, provided the country remains on its current trajectory. Moody’s senior analyst, Lucie Villa, said that the country currently has a stable economic outlook, strong institutions and reasonably good foreign currency reserves.

This sentiment is supported by the fact that some political gains have been made under President Cyril Ramaphosa. These include a clamp down on corruption with the firing/resignation of certain dubious political members, and the progression of the state capture inquiry. Key institutes have been strengthened, with new appointments to the Treasury (Tito Mboweni), judiciary (the new NPA head is Shamila Batohi) and SARS (the new commissioner is Edward Kieswetter). New executive boards have also been appointed to troubled SOEs such as Eskom, Transnet, Denel and PRASA. Economic reforms are also well underway, with Investment and Presidential Convoy Summits raising R320 billion. A R50 billion fiscal stimulus package has also been earmarked to stoke local economic growth.

Global growth may be slowing, but China (+6.3%) and the US (+2.4%) are still forecasted by the IMF to grow quite healthily over 2019 and 2020. This is good for South African exporters, in particular commodity producers, with healthy demand still being experienced from South Africa’s two largest trading partners. As a result, commodity prices are still showing robustness, especially in platinum group metals (PGMs), gold and iron ore, which is good for an extension in the recent rally experienced in the resource sector.

What does this mean for returns in the short and medium term?

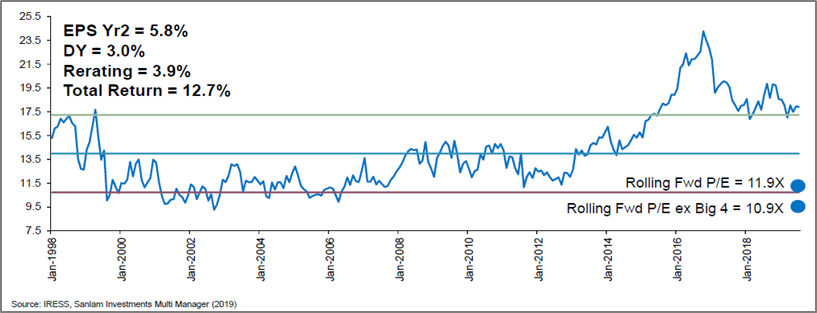

Inflation in South Africa is currently at 4%, and remains in check within the South African Reserve Bank’s (SARB) target range of 3 – 6%. Subsequently, South African fixed-income assets are currently generating real returns with low risk. Cash (Money Market Funds) is yielding approximately 7.2% and bonds (ALBI) are currently yielding 9.3%. With inflation in check, the SARB Monetary Policy Committee is not expected to cut interest rates aggressively in the near future, although the Committee could do so intermittently to keep in line with global peers that are cutting rates and engaging in monetary stimulus. South African equity and property currently show attractive valuations, with rolling forward P/E multiples well below long-term means. This demonstrates cheapness in the market, however, there are still notable headwinds facing South African domestic-focused equity and property counters. Nonetheless, total return expectations for South African equity over the next 12 months are in the double digits.

ALSI valuation as at 30 June 2019:

Best Investment View portfolio positioning

Manager exposure

Given the extreme difficulty in calling winning asset classes, let alone sectors of the market that will outperform, the decision to allocate to direct building blocks in a retail portfolio has become exceedingly difficult, particularly in a sideways-moving market as seen over the last five years. Subsequently, the approach of the Best Investment View (BIV) proposition leans towards the use of multi-asset funds as core to portfolio construction, with satellite funds used to enhance return expectations by gaining exposure to a specific beta. The flexibility of multi-asset funds allows for nimble adaption to the prevailing market environment. The return environment for South Africa and global risk assets has been somewhat bleak. Majority of the funds being utilised across the proposition are multi-asset, absolute-return focused, or cautious to low-risk strategies, benefitting from strong returns delivered through the local bond market. We believe this to be the best approach to protecting capital for clients, yet positioning to benefit from any strong recovery in risk assets.

Portfolio positioning

Looking at the broader business cycle, it is safe to say that we are ‘late cycle’ and well into a slowdown environment in which growth slows and stagflation occurs. Subsequently, interest rates move lower in this environment as well. This is usually good for equities, as the cost of capital lowers, with the effect of hopefully spurring on growth. From an equity perspective, exposure to large-cap quality (industrials/selective resources) and defensive (utilities, consumer staples and gold) stocks tend to do well. In terms of fixed income, short-term bonds and cash tend to generate the better performance in this particular asset class. The Best Investment View portfolios have been tilted to benefit from this throughout the year, with higher allocation to multi-asset income funds and quality multi-asset high equity and flexible funds.

Within the higher-risk Regulation 28 compliant portfolio (a moderately-aggressive risk profile), we decided to remove the explicit allocation to emerging markets, via the Coronation Global Emerging Market Flexible Fund. This decision was primarily based on our view that risks in the shorter term are elevated due to a less favourable outlook for Earning Per Share (EPS) growth in the coming 12 months. However, we remain constructive on emerging markets over the longer term, so this move is more tactical than structural. The proceeds were deployed to the Abax Balanced Prescient Fund and Bateleur Flexible Prescient, thereby reducing their respective underweight positions and slightly increasing the domestic equity exposure at the expense of offshore equity. South African equity still remains underweight relative to our internal benchmark.

Comments are closed.