No pain, no gain

Looking at your investment returns less often could improve your investment outcomes.

A deeper understanding of human behaviour enables us to best assist clients in managing their wealth over the long term.In this feature we draw on the insights of thought leader Richard Thaler, the 2017 Nobel Prize winner in Economics. He is best known for his work in behavioural economics, built on previous work by Tversky and Kahneman. Thaler has applied his findings to the world of finance, dispelling assumptions that human beings behave rationally when it comes to investing.

Myopic loss aversion: Robbing investors of long term returns

Myopic loss aversion is arguably one of the most powerful insights brought to light regarding the investment industry. It is the behavioural bias that most often robs investors of higher long- term returns. This negative bias is explained by Thaler as a ‘greater sensitivity to losses than to gains, and a tendency to evaluate outcomes [too] frequently’.

This means that people have much stronger, longer-lasting reactions to losses, than to gains.In the investment world this bias is further fuelled by the tendency to monitor investments over inappropriately short time periods. This causes undue stress and an increase in negative reactions due to short-term volatility in the market. Investors should rather be encouraged to stomach the short-term volatility and focus on the superior rewards of long-term returns.

People have much stronger, longer-lasting reactions to losses, than to gains

Loss aversion in practice: the cost of performance chasing

A real world example highlights the implication of myopic loss aversion:

In a blog post by Ben Carlsson, titled Peter Lynch’s Track Record Revisited, it was shown that although the famed investor earned 29% per annum over 13 years for the Magellan Fund, the average person investing in the fund only earned around 7% over that period. This was a direct result of money flowing out of the fund every time there was a setback in performance, and only returning to the fund after a recovery period. In other words, investors would wait until the fund was already doing well again before re-investing, resulting in a ‘selling low and buying high’ scenario born from anxiety. This tendency to anxiously chase performance is a result of myopic loss aversion and is much to the investor’s detriment.

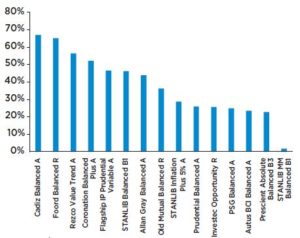

In the South African market the tendency to continuously chase past performance is prevalent. We took a look at 20 funds in the ASISA High Equity category that had 10-year track records and the relevant flow data. We found that 15 of these funds showed a positive correlation between performance and flows; increased performance was later followed by an inflow of money. Seven of these funds had a strong positive correlation of 40% to 70%.

When looking at the Coronation Balanced Plus fund from the ASISA High Equity category, that forms part of the Sanlam Investments Multi- Manager’s best investment view, we can see that following top quartile performance the fund delivered 10.7% per annum to committed investors. Had investors chosen to withdraw money after drawdowns and only invest again after recovery, they would have gained less over the period (7.2%). The 3.5% difference is sizeable, particularly when compounding takes effect.

Over a 10-year period the difference in investment outcomes would amount to 28% and this could increase to 62% over a 30-year period.

This tendency to anxiously chase performance is a result of myopic loss aversion and is much to the investor’s detriment.

Figure 1: Correlation of performance and flow

The correlation of the 15 managers who had a positive correlation between returns and fund flows

Source: Morningstar (2018)

Figure 2: The Cost of Myopic Loss Aversion

The outcome if you invested R100 in Coronation Balanced Plus A over 10 years (to the end of February 2018) with a performance chasing strategy versus a buy-and-hold strategy – with a 7.2% and 10.7% return respectively. The hypothetical outcomes over 20 and 30 years assuming the same 7.2% and 10.7% return is also highlighted.

How to avoid the myopic loss aversion pitfall:

There are two remedies for myopic loss aversion:

- Investors should evaluate their investments less frequently, as this will allow them to be more accepting of shorter-term risks in exchange for longer-term gains.

- When investors see that they will be rewarded for the minor risks they take, they are more willing to take them.

The Sanlam Investments multi manager approach

In Thinking Fast and Slow, Daniel Kahneman suggests that the best way to manage such cognitive biases is to put in place systems that mitigate them. Myopic loss aversion is something that we at Sanlam Investments Multi-Manager remain acutely aware of. In order to manage its negative effects on investors, we do extensive research on our managers and their style betas, and we rate these managers based on skill and risk. By understanding the managers’ style beta we can formulate expectations and manage the emotional component of possible losses by asking, ‘what outcome can we expect from this manager based on their philosophy, process and expected style beta?’, and communicating expected outcomes due to downturns to investors beforehand. During expected downturns we rebalance across funds, bringing them back to a strategic level at which we have the opportunity to buy low and sell high.

Managing risk: A short-term view will cost you in the long run

Thaler et al concludes that: investors who evaluate their investment outcomes too frequently are unable to stomach the short-term risk in their portfolios and therefore make less money. Thus the key to investment success, we believe, is not avoiding risk but navigating it while remaining cognisant of the ever present risk of human emotion in long-term money management.

Investors who evaluate their investment outcomes too frequently are unable to stomach the short-term risk in their portfolios and therefore make less money.

Comments are closed.