May 2021 economic review

Introduction:

As nations continued the restart of their economies during the month of May supported by vaccinations in the respective populations, the market showed concerns that upside data surprises may result in more persistent inflation. It would force central banks to bring about a premature end to the growth rebound. This emphasises that investors seem to be particularly worried about inflation in the long term and the varied effects it can have on the market. Despite these concerns, economic activity has been very strong over the month of May, due to the ongoing vaccine rollouts allowing economies to gradually re-open, as well as sizeable fiscal support, particularly in the UK and US.

COVID-19 Vaccine Rollout:

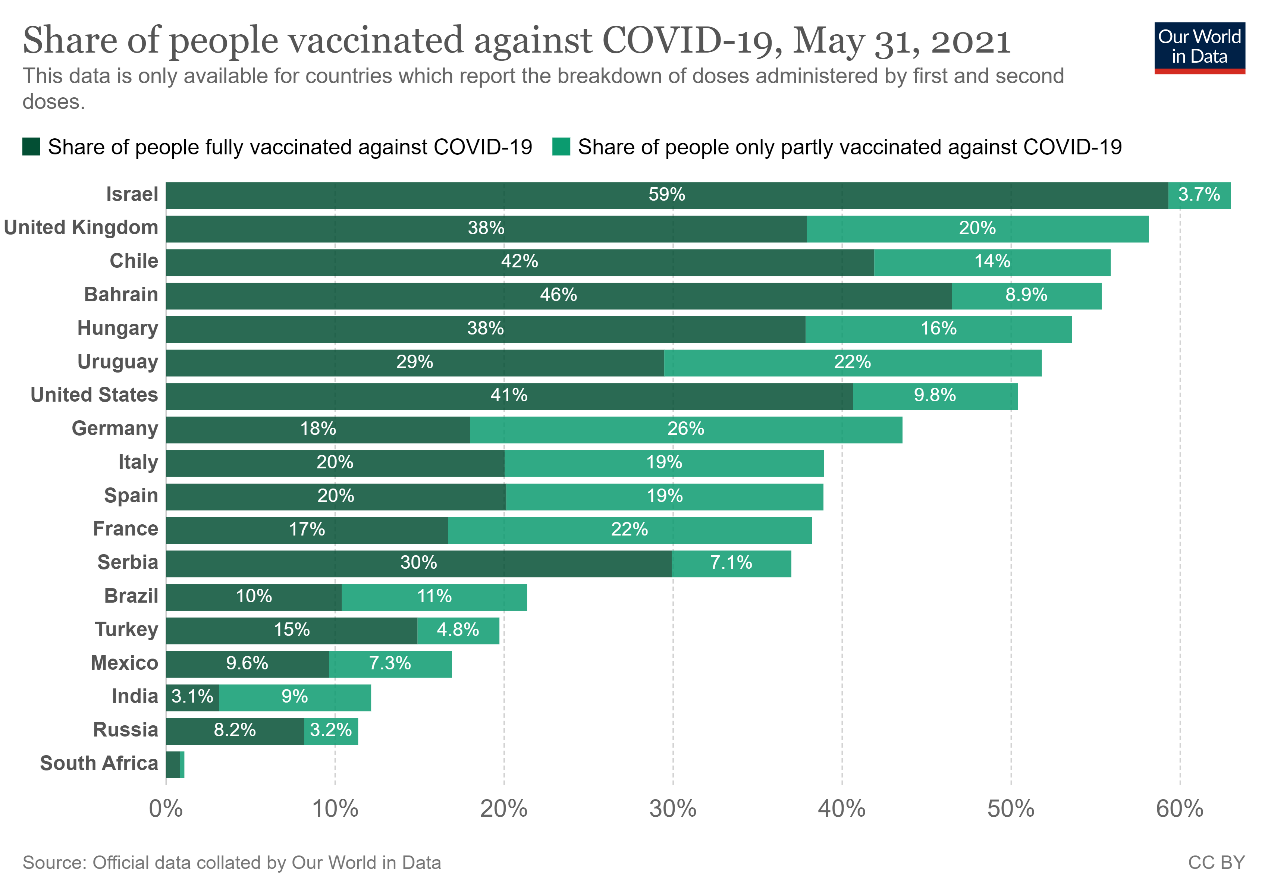

Vaccine efficacy continues to be strongly positive, with low hospitalisations in countries where the vaccine rollout has been progressed far enough to protect the vulnerable age groups. India, however, is experiencing a health crisis, which underlines the importance of a rapid rollout of vaccines globally. On a positive note, India is making good progress with over 190 million vaccines so far administered (only behind the US and China in the total number of rollouts thus far). This progress, combined with a relatively young population, bring hope that the worst of the Indian health crisis could be over within a few months. The UK also continued its roll-out, with more than 50% of the population vaccinated fully/partially in their efforts to combat the virus.

Emerging markets continue to lag in vaccination rollouts compared to developed markets, however, China is picking up pace and the emerging markets Asia region seems to be better paced than other regions.

South Africa’s rollout has been slow, with 0,81% of the population fully vaccinated, and 0,27% of the population partly vaccinated as at 22 May 2021.

Europe’s significant increase in the percentage share of populations vaccinated during May has increased confidence in Europeans and the economic outlook for their future. Thus, it’s in the interest of authorities in SA and other countries in the world to follow suit of the example set out by Europe and shift intentions of getting populations vaccinated, in order to support their economies.

China allows its citizens to have a third child:

In 2020, China had only 12 million newborn babies, a drop of around 20% from 2019 and the country’s lowest population growth since the 1960s. The government had decided “one child is enough” per married couple for a generation, however on 31 May 2021, it was ruled that couples could have three children. Government officials feared that the economic growth would fall with a declining population, and thus further relaxed birth-control policies that would help China fulfil its goal of dealing with an ageing population. However, it is argued the policy has come too late, as what China now allows is increasingly out of step with the trend of young women postponing or avoiding marriage and children. The question asked is: Will such a mindset change in the future?

SA unemployment statistics:

Statistics SA recently released the Quarterly Labour Force Survey for the first quarter of 2021 and the results were disheartening. The number of unemployed persons increased by 0,1% to 7.24 million from 7.23 million in the final quarter of 2020. SA’s official unemployment rate now sits at a record high of 32,6%. The unemployment rate according to the expanded definition of unemployment that includes persons discouraged from seeking work increased by 0,6% to 43.2% of the labour force for the first quarter.

Statistics SA said job losses in the first quarter were recorded mostly in construction, followed by trade, private households, transport and agriculture sectors. SA is still struggling to shake off the effects of a recession prior the pandemic highlighting the need for faster structural reforms. These involve polices to boost competition, improve the regulatory framework, as well as improve the public investment in transport infrastructure, skills and education.

US:

The headline acts for the month were growth and inflation and they did not disappoint. The US Purchasing Managers Indices (PMIs) for manufacturing and services both beat expectations in the month of May, as they rose to their highest levels. The results of these PMIs highlight that consumer demand remains optimistic in the US, but also businesses in the US are now facing higher input costs. US corporate earnings for the first quarter of 2021 was much stronger than expected, however the S&P 500 only gradually rose in May, due to the technology and consumer discretionary sector (40% of S&P 500 index) being under pressure.

In other interesting news, the US has called for the World Health Organization (WHO) to carry out a second phase of investigating into the origin of the coronavirus.

Europe:

After a relatively slow start, vaccination rates have begun to increase. Across the major economies in Europe, an estimated 0.8% of the population per day is being vaccinated. The prospects of a strong growth rebound this year has risen, which have positively affected the outlook for European equities. The eurozone PMIs for May were also positive, with vaccinations appearing to now be boosting the confidence in the services sector.

Global Markets

Global equity markets recorded gains for a fourth consecutive month at the end of May. The MSCI World Index returned 1,26% month-on-month in US$ and – 4,24% in ZAR. European equity and US equity markets obtained positive returns over the month. FTSE (£) up 1,11% month-on-month, Euro Stoxx 50 (€) up 2,53% and S&P 500 (US$) up 0,70% month-on-month. European equities once again outperformed other regions. In May, the MSCI Emerging Market Index returned 2,12% month-on-month in US$ and – 3,42% in ZAR. After a very strong run from the start of 2020 to February this year, Asian equities have given back some of their gains in the last quarter before rallying in the latter half of May. Growth stocks have led the decline in Asian equities, due to Chinese growth stocks being corrected (decline in the stock price) by over 20% since February this year. Despite this, emerging market equities outperformed developed market equities for the first time since January. In a trend that has been dominant for the past few quarters, equity markets were dominated by cyclical, value stocks.

Expectations of stronger economic growth and inflation led to a strong rise in global inflation-protected bonds backed by strong demand.

Local Markets

The South African equity market managed to produce another month in the” green”, as the FTSE/JSE All Share Index closed the month at 1,56%.

On a sector basis for May, Financials led the pack at 9,17% month-on-month, Industrials closed at 0.90%, and Resources lagging somewhat at -1,39% month-on-month. Noticeable sectors that took a hit in the month of May, include the Technology ( -7,89% month-on-month), Chemicals ( -7,30% month-on-month) and Forestry (-11,57% month-on-month). SA Bonds outperformed Emerging Market peers, as the All Bond Index closed the month at 3,73%. Cash once again gave a mediocre performance, as expected in a low interest rate environment, with the STEFI returning 0,31%.

Our currency continued to show strength and continued its strong run, closing stronger against most major currencies in May. The ZAR gained as much as 5,74% against the US$, followed by 4,11% and 2,99% against the euro and sterling respectively, and was relatively flat relative to the Japanese yen (0,08 %).

Comments are closed.