Market summary Q3: Tweets, tariffs and tantrums

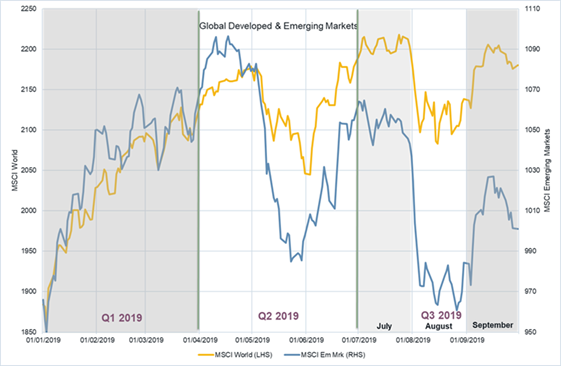

The third quarter of 2019 was once again dominated by heightened volatility across local and global markets. The primary drivers of market sentiment remained the trade developments between the US and China, the continued softening of global economic data, central bank monetary policy, and whether the global economy will go into recession.

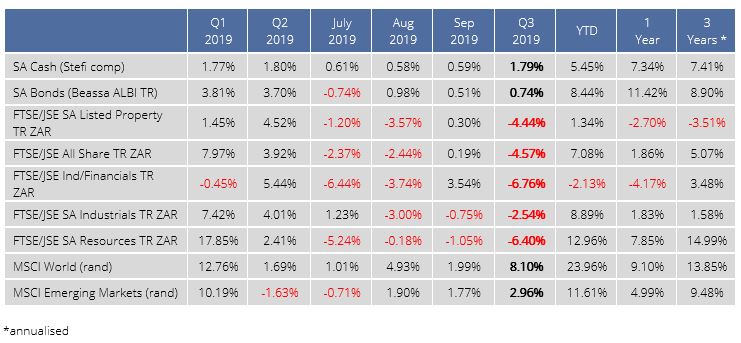

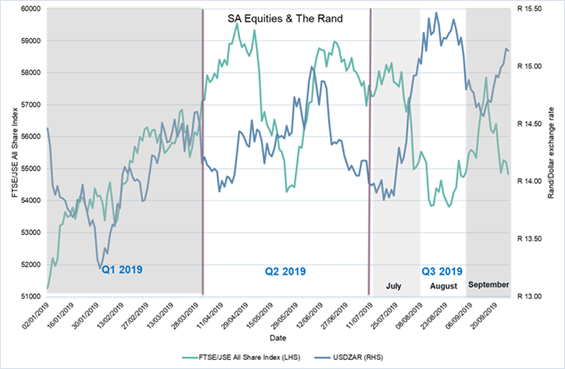

Markets disappointed local investors once again, with both SA equity and SA property ending the quarter in negative territory. A sharply weakening rand over the quarter helped SA investors who had offshore exposure. While global equities led the way, local cash and bonds also delivered positive returns in a largely risk-off environment.

Markets disappointed local investors once again, with both SA equity and SA property ending the quarter in negative territory. A sharply weakening rand over the quarter helped SA investors who had offshore exposure. While global equities led the way, local cash and bonds also delivered positive returns in a largely risk-off environment.

During July, global asset classes outperformed their domestic counterparts as expectations of a US Fed rate cut triggered rate cuts in Turkey, Russia and South Africa. The best performing asset class was emerging market bonds, followed by global equities and global listed property. South Africa failed to benefit from the rate cut environment, as expectations of a ratings downgrade and ongoing fiscal slippage weighed on bonds. The R59 billion additional bailout for Eskom and expectations of revenue shortfalls were the catalysts for the rise in yields. Domestic equities brought up the rear, dragged lower by resource and financial stocks. Global recession fears weighed on resources, whereas downward revisions to domestic growth hurt financials.

Risk assets sold off sharply in August as negative news flow triggered a flight to safety. An intensification of the US-China trade war, Boris Johnson’s suspension of the UK parliament, concerns about a possible German recession and a meltdown in Argentina all contributed to the negative sentiment in global equity markets. The inversion in the US yield curve added further fuel to the fire signalling the onset of a US recession, the current driver of global growth. Rand depreciation, however, buoyed rand returns from offshore assets, helping to prop up balanced fund returns over the month. On the domestic front, SA equities tracked their global counterparts lower, with financials in particular selling off on the signing of the National Credit Amendment Bill into law. Concerns about the adoption of National Health Insurance and the bail-outs to Eskom and other SOEs weighed on the bond market as estimates for the fiscal deficit were revised higher, to in excess of 6% of GDP in the current fiscal year. Global bonds were the best performing of the broad asset classes in rand terms, followed closely by global inflation-linkers. Domestic listed property and domestic equities, in turn, brought up the rear on expectations that the SARB had limited scope to cut interest rates or for government to inject a much-needed fiscal stimulus into the economy.

September was once again dominated by news flow regarding trade developments between the US and China as talks were scheduled to resume in October. September was characterised by two distinct regimes: risk-on until the 16th, and then risk-off until month-end, leaving SA investors with not much returns to show. As anticipated by investors, the US Federal Reserve cut interest rates by 0.25%; however, their guidance on the path of interest rates was not well received as investors began to price in more aggressive rate cuts than expected. President Trump once again slated Fed chair Jerome Powell for being reluctant to cut rates in line with global peers. The end of September was characterised by House Speaker Nancy Pelosi’s official endorsement to begin the process of an impeachment inquiry into President Donald Trump. Both consumer confidence and manufacturing data missed estimates in the US as investors continued to closely monitor incoming economic data. The price of Brent Crude jumped sharply following a drone attack on Saudi Arabian infrastructure; however, the price trended lower as supply was increased.

The fourth quarter will also be filled with investors scrutinising economic data and awaiting any developments in geopolitical tension. Major upcoming events include the deadline for Brexit, two more US Fed meetings, the OPEC summit, as well as local events such as the medium-term budget policy statement on 30 October and a sovereign credit rating by Moody’s on 1 November.

Although volatility remains elevated, we still believe investors should remain close to their strategic asset allocations. From a positioning perspective, we still believe it is time to be diversified and be more neutral regarding risky asset exposure as valuations are not horribly out of kilter.

We will continue to engage with you regarding our assessment of financial markets and whether this may lead to any material changes in asset allocation or manager selection.

Comments are closed.