Market summary: Q2 2019

By Wade Witbooi, Portfolio Manager at SMMI

The second quarter of 2019 once again highlighted the impact geopolitics can have on financial markets. The quarter began with a rally in global markets that was driven by the dovish pivot of the US Federal Reserve over the previous few months. This was seen as potentially pushing out or even preventing a US recession in the coming months.

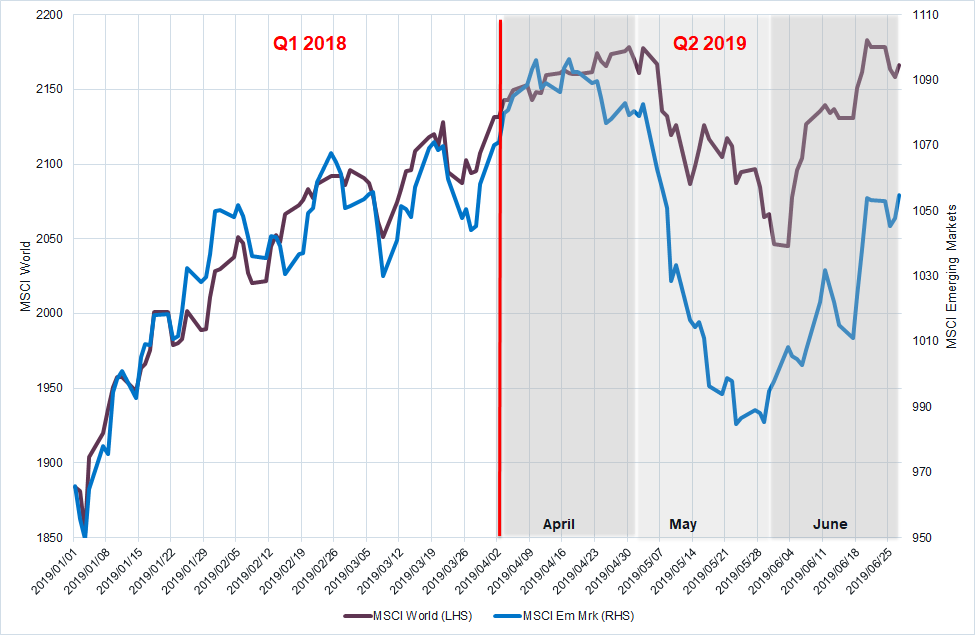

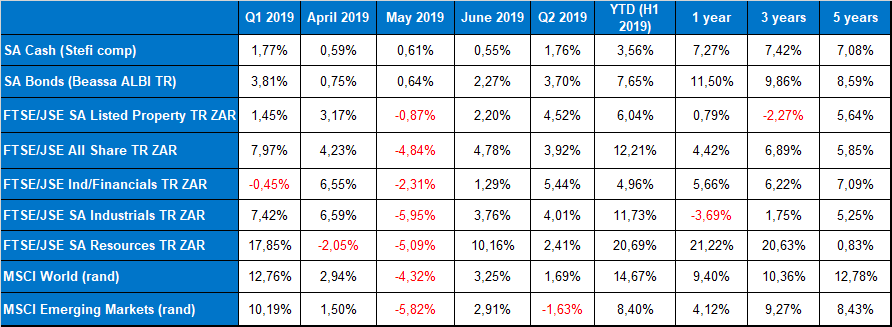

The IMF downwardly revised global growth expectations during the quarter from 3.5% y/y to 3.3% y/y but markets broadly shrugged this off amidst the accommodative monetary policy environment. Global equities returned 3.6% ($) in April and Emerging Market equities returned 2.1% ($). Global bonds declined slightly by 0.2% ($) and emerging market bonds declined by 0.7% ($).

The first significant political impact on the markets occurred when Donald Trump imposed additional tariffs on China, announced via his favourite social media app, Twitter (5 May). Sentiment across global financial markets rapidly reversed as investors fled risk assets for safe haven assets (US bonds & gold). The downward trend in financial markets continued for the month of May. President Trump did allay some fears that the trade war would not escalate further by tweeting that he and Xi Jinping had fruitful conversations and that they would meet once again during the G20 Summit at the end of June. The US Fed further amplified their dovish tone, but this didn’t stem losses in the month. The MSCI World and EM indices declined 5.8% and 7.2% in dollars respectively.

The strong rebound across global financial markets in June came as a slight surprise. Investors largely took direction from the US Fed and returned to risk assets while clarity was still sought from a trade perspective. A further tailwind to global markets was a continued dovish tone from the European Central Bank as they confirmed their commitment to ease monetary policy. The MSCI World and Emerging Market indices rose 6.5% and 5.7% in dollars respectively.

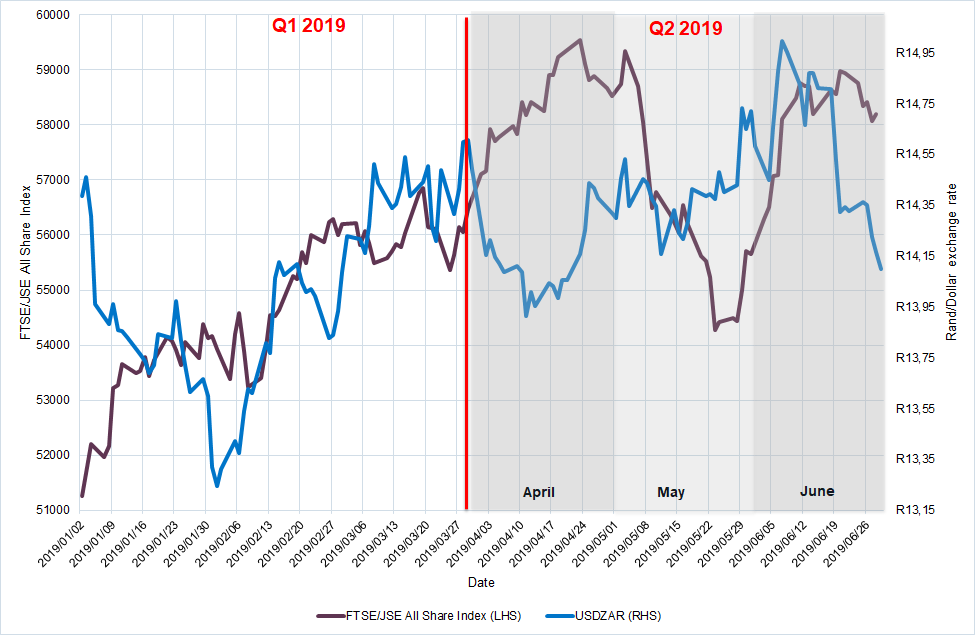

Locally, both politics and global sentiment impacted markets. April saw strong gains in the All Share Index (4.2%) driven by increased global risk sentiment. Key drivers of returns were financials and industrials that were up 7.6% and 6.5% respectively.

May started positively, with the local election going smoothly. President Cyril Ramaphosa’s ANC won quite comfortably and there was a sense that he would be able to deliver on the reforms that were the cornerstone of his campaign. The Q1 GDP contraction of 3.2% caught the market by surprise and highlighted the job the president has in creating the correct business environment and consumer confidence. The disappointing local economic data added to the global risk-off sentiment as the All Share Index fell sharply, losing 4.8%.

The local market caught the tailwinds of the global market risk-on rebound in June. The local equity market delivered 4.5%, with gold counters leading the gainers. An additional supporting factor was the indication from the South African Reserve Bank that a rate cut or two may be on the cards as a result of subdued inflation and weak economic growth. A rate cut and potential fall in petrol prices would be a welcome relief for the local consumer.

For the remainder of the year, accommodative monetary policy is likely to be a theme as weak inflation continues to be a concern for central banks. The Fed in particular seems quite intent on trying to maintain the economic expansion. However, interest rate cuts both globally and locally cannot be viewed in isolation. Global geopolitical risks, especially the US-China Trade War, and weak global economic data have continued to test the assumptions of financial markets.

Comments are closed.