Market Sell-off…Buying Opportunity or Bear Market?

The recent market decline has certainly dented investors’ conviction in markets, who, as a result, could be inclined to think of this as the start of a global bear market. While it could be said that South Africa has been in a bit of a bear market already, it poses the question whether this is indeed a buying opportunity or whether the negative news flow stems from the introduction of a global recession, and as such, is just the tip of the iceberg.

South African investors have been on the receiving end of low returns for the past three years, with just 2.6% per annum earned from a typical balanced portfolio, as at the end of October 2018. This has been significantly less than cash, which produced 7.4% per annum over the same period. The source of this underperformance is the lack lustre returns from the South African local equity and listed property markets, which have only returned 2.06% and -2.64% per annum respectively over the same period.

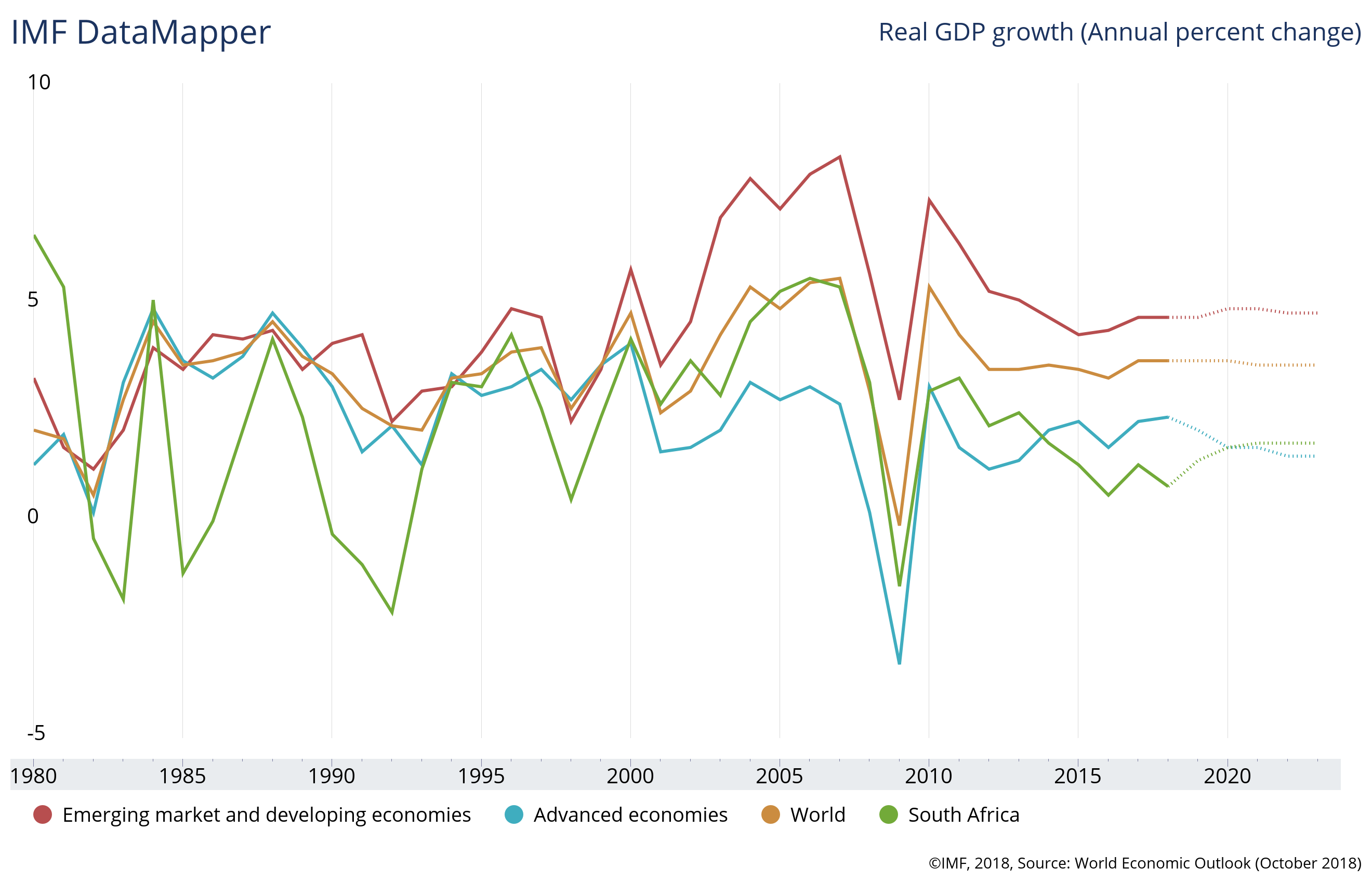

The below-par returns from these two primary asset classes that have historically rewarded investors handsomely can be attributed to, (1) weak economic fundamentals, (2) South African GDP growth of under 1% compounded by (3) an uncertain political and policy environment. This has occurred whilst the rest of the world has been growing above 3.7% and while offshore markets have on average delivered 10.4% per annum. The fear now is whether this sustained global recovery can last long enough to see a recovery in the South African economy.

Graph 1. Global GDP Data

The latest decline in markets (since the start of September this year) can largely be attributed to global factors and sentiment such as the continued escalation of the trade war between China and the US (Donald Trump leading the charge) and the US Federal Reserve tightening its monetary policy stance, as the US sustains its recovery post the global financial crisis. The market’s perception is that a continued trade war between the two biggest economic powerhouses will derail the sustained synchronised global economic recovery. US consumers import approximately $500bn of goods from China and the current import tariffs stand at $200bn on imported goods. Should this continue to escalate, consumption growth might suffer and GDP growth could decline, hurting the prospects for company profits. Over and above this, the market is coming to terms with tighter monetary conditions in the US. Jerome Powell (chairperson of the US Federal Reserve) continues to normalise interest rates through sustained and consistent hikes, which have ultimately been introduced to cool the economy and temper inflation, albeit moderately.

Closer to home, we have seen poor performance from parastatals, rising costs of petrol and electricity and changes to the cabinet, the most notable being Nhlanhla Nene resigning as Finance Minister on the eve of the mid-term budget speech. More recently, Malusi Gigaba also resigned as Member of Parliament. Fortunately, South Africa can lean on credible stalwarts such as Tito Mboweni who takes over the reins of the finance ministry to stabilise confidence in the Treasury. Moody’s has maintained an investment grade rating on South African bonds and have yet to indicate whether they will be changing this rating, despite the mid-term budget speech having been delivered close to a month ago. They have indicated that South Africa’s political risks have declined since the change in leadership, but would like to see significant transformation in the management of SOEs.

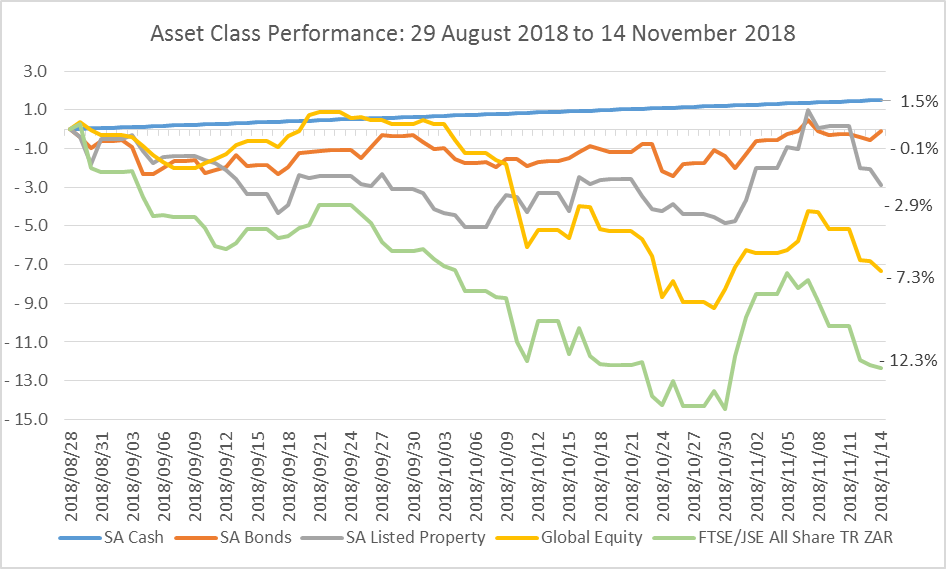

This poor performance has seen most local asset classes decline and whilst offshore assets protect capital for the most part, global investors have de-risked across the board, leading to global equity markets declining since September. The Graph below depicts this tough period for investors where performance across the board has underwhelmed apart from cash, which has essentially been the only safe haven. Short term base effects will also ensure there is no rest for the weary as a strong October 2017 (for domestic equities in particular as the ALSI returned 6.26%) falls out of one-year returns and is replaced by a tough October in 2018 (-5.76%). The last two days of October did at least see a dramatic bounce in the South African market, but this was sadly, short-lived.

Graph 2. Local and global asset class performance

Source: Morningstar

The question that all investors should be asking themselves is whether the recent decline in markets presents a fantastic buying opportunity or whether it signals the start of a global bear market? Our view is that this is most certainly a buying opportunity. Our main motivation stems from the positive economic fundamentals that still exist not only in the US, but across other parts of the developed world such as Europe and Japan. While trade wars should continue in the short term and can have an effect on global GDP growth, our research currently suggests that economic expansion is still robust, albeit slowing moderately.

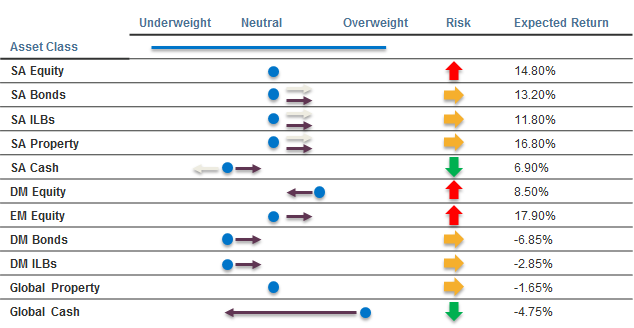

Over and above this, the valuation of the market (the price investors are currently paying for companies) is very attractive, particularly emerging market and South African equities. While these markets have experienced the most volatility and drawdowns, the market is pricing them for recession and we do not believe a recession is on the horizon. Below is a table that displays our expectations for asset class returns over the next 12 months. It must be stated that we do not hang our hats on these point-in-time forecasts, but use them as a guide around which asset classes to overweight or underweight within portfolios, dependent on expected return for the level of risk accepted.

Graph 3. Asset class expectations

Source: Sanlam Investments Multi Manager

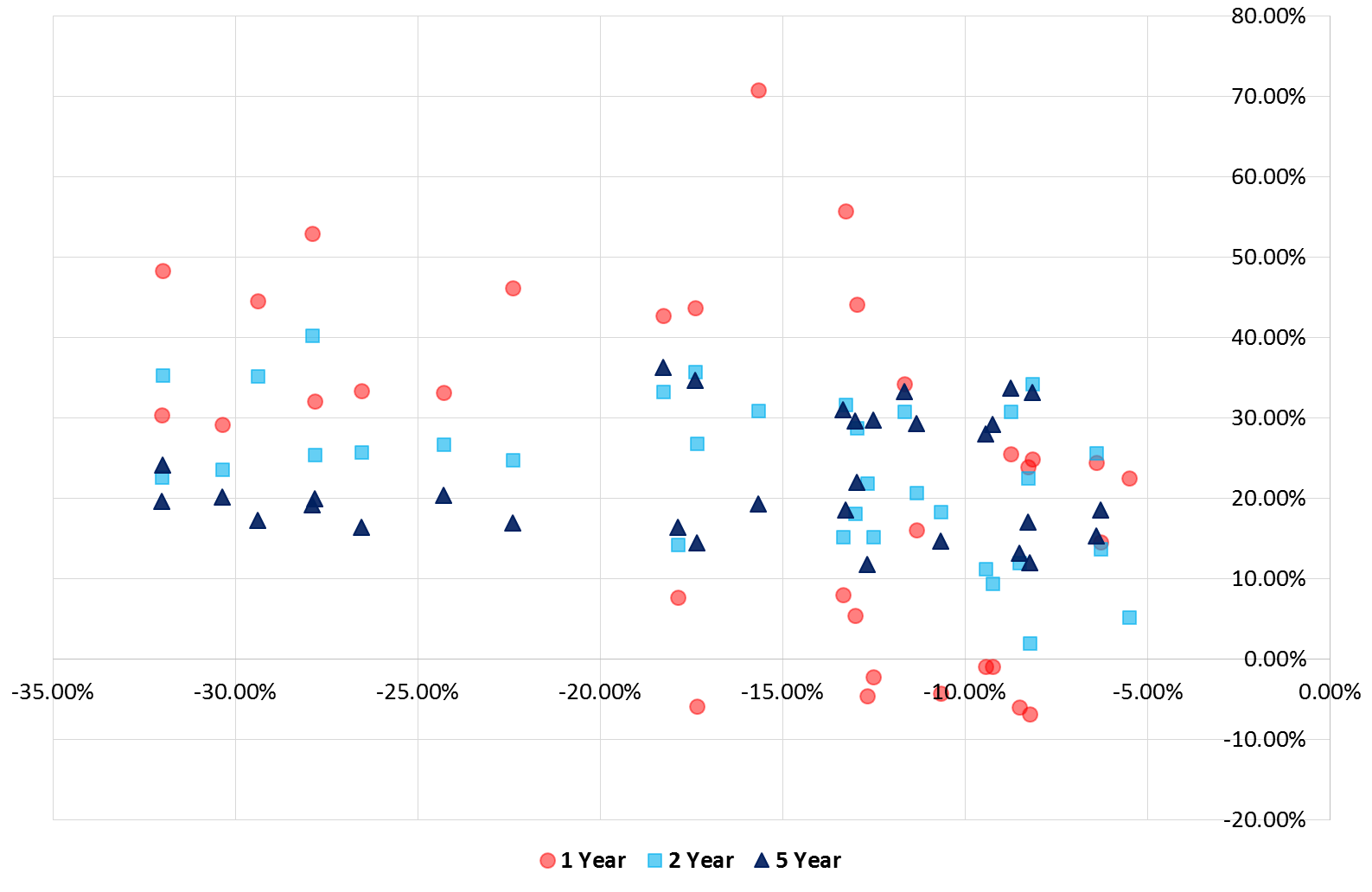

To further our understanding of how markets react after a significant decline, we look to the past, not as a predictor of future performance, but to investigate the breadth of subsequent equity market returns when the market falls by more than 5% on a rolling six-month basis.

The first important outcome to focus on, is the magnitude of the possible six-month drawdown. Out of a possible 274 negative six-month periods, there were only 34 periods where the decline exceeded 5%, 23 of which exceeded 10%. That translates to only 12% of market declines being larger than 5% in magnitude and only 8.4% of all relevant declines being larger than 10%.

The graph below shows one-year, two-year and five-year returns after each of the 34 periods where a 5% drawdown occurred over a six-month rolling period. The horizontal x-axis talks to the magnitude of the initial decline, and the vertical y-axis shows the magnitude of the return earned in the subsequent one, two and five-year periods.

Graph 4. Market returns after a 5% decline

Source: Sanlam Investments Multi Manager

Over the short-term (12 months), the breadth of market returns was wide, as there were one-year periods with returns in excess of 70%, but there were also years where the sell-off continued. In these continued negative return years, the selloff never exceeded a further 10% loss.

Over the long-term (five years), the picture is more positive. Following any drawdown that exceeded 5%, the market went on to return more than 10% annualised over all subsequent five-year periods.

We maintain the view that owning equity market risk should be rewarded in the form of returns, on the premise that we do not see a global recession on the short-term horizon. The current market decline can largely be explained by the escalating trade war and rising interest rates in the US. This translates into negative sentiment towards equity markets and adds to their volatility, especially in the case of emerging markets. We remain diversified across various asset classes as this helps to mitigate capital loss in times of crisis (should one occur). It is unadvisable to try to time one’s entry or exit with respect to markets; However at current suppressed valuations, if any applicable good news comes to light, these valuations should provide a good underpin for returns to investors. Rest assured we are positioned to capture the upside should it transpire, within the mandated parameters of portfolios. History points towards favourable long-term outcomes post a market correction, and although we remain cognisant of appropriate risk levels within portfolios, now is not the time to capitulate on long-held investment strategies and plans.

Comments are closed.