Market Overview 2018

At a glance

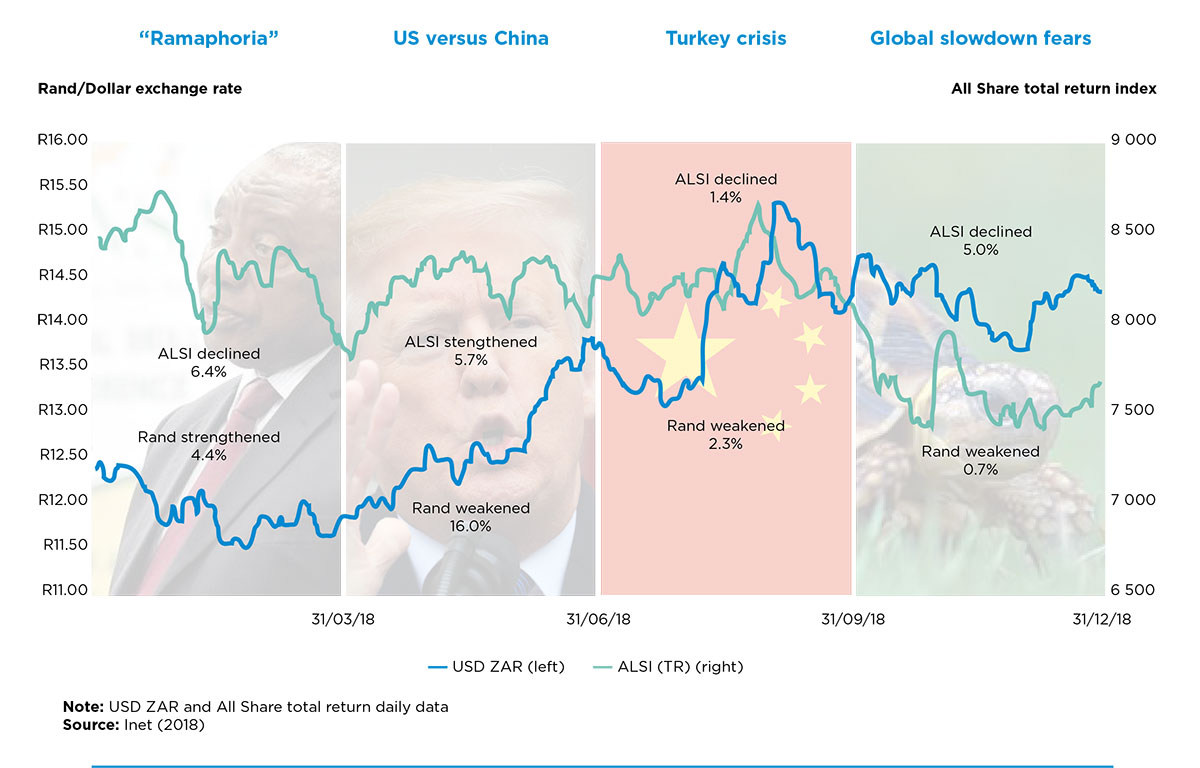

Risk assets over the last year have been hit hard by a slowing world economy, less support from central banks and trade concerns. A brief glance backwards helps explain the challenges investors now face. Last year, most heralded 2018 as the year of synchronised global growth. The theme did not really pan out, as the US expansion far outstripped that of most developed economies thanks to fiscal stimulus. As the global economy weakens, central banks are signalling that they are aware of the risks for 2019. The year 2018 proved to be somewhat of a tipping point for emerging economies as global headwinds converged. These dynamics are likely to continue into early 2019, but the rhetoric and sentiment are not all bad. Valuations are starting to look attractive across markets and some political risks have eased incrementally. All said, this could prove a good entry point for long-term investing.

As such, should investors accept the market’s warning signs of a downturn or embrace risk amid cheaper valuations? And, can positive fundamentals outweigh lingering headwinds?.

2018 – Q1: “Ramaphoria”

2018 started with positive sentiment in South Africa, with the victory of Cyril Ramaphosa over Nkhosazana Dlamini-Zuma at the ANC elective conference in December 2017. Global economic growth was expected to be fairly robust, with the United States expected to be the primary driver of growth.

The quarter started with a significant strengthening of the rand against the US dollar, reaching R11.55 per US dollar at its strongest level. For context, just after the medium term budget policy statement delivered by then Finance Minister Malusi Gigaba in October 2017 the rand/dollar exchange rate was R14.20. Supporting the pro-South Africa view, companies that are sensitive to South African sentiment, such as banks and retailers, delivered stellar returns in the first quarter of 2018: Mr Price (16.8%), Foschini (22.5%), Standard Bank (13.8%) and Nedbank (9.6%) led the gainers. Due to the strengthening of the rand and some stock specific reasons many rand hedges struggled in the first quarter of 2018. During the quarter several stocks fell around 20% from peak to trough: Naspers (-23.3%), British American Tobacco (-25.5%), Richemont (-10.2%) and BHP Billiton (18.1%). As the majority of the earnings on the JSE are foreign generated the market declined 6.33% in rand terms.

2018 – Q2: US versus China trade wars

The second quarter of 2018 started with a sharp reversal in emerging market sentiment primarily driven by the first stages of trade war policies being implemented. On 8 March US President Donald Trump authorised tariffs of 25% and 10% on steel and aluminium imports respectively. South Africa’s exports to the US are also included on the list of tariffed goods. Subsequently China retaliated with tariffs of its own on US goods. The tit-for-tat continued on 15 June 2018 when an additional tariff of 25% was implemented on Chinese goods. The weakening rand benefitted the FTSE/JSE All Share Index (ALSI), which rose 5.7% in rand terms.

2018 – Q3: EM contagion: Turkish currency crisis

In August, the Turkish currency crisis worsened and caused a knock-on sell-off in other emerging markets. Many Turkish companies have debt denominated in euros or dollars and their ability to pay the interest were questioned, which led to weakness in European financial stocks. In addition, relations between the US and Turkey declined following the arrest of a US pastor on terrorism charges. President Trump thereafter approved tariffs on Turkish steel and aluminium. The rand declined from R13.22 to R15.23 versus the US dollar over the course of a month. The ALSI fell 1.4% as a result of the emerging market contagion.

In September, the US Federal Reserve (Fed) decided to raises interest rates for the third time in 2018. Factors highlighted in their decision included strong household spending, corporate investment, labour market growth and inflation. During the press conference Chairman Jerome Powell indicated that more rate hikes were likely as the US economy continues to strengthen.

2018 – Q4: Fears of global slowdown increase

The Fed remained fairly hawkish in September, which spurred fears that, together with a trade war, hiking interest rates too aggressively might potentially derail the global growth cycle and plunge the world into recession. Increased volatility and a flattening of the US yield curve triggered a sell-off in global equities with the MSCI World decreasing 13.42% in US dollar terms.

This rhetoric on the path of interest rates changed in November as the Fed sounded increasingly dovish and stated the path from here will be increasingly data dependant. The Fed raised rates for the fourth time in December.

The South African Reserve Bank caught many investors off guard with a rate hike in November. The rate hike aided in stabilising the rand to some extent. The ALSI declined 5% during the quarter, on the back of the global sell-off as a result of increasing global growth slowdown fears.

2019 outlook

Trade restrictions between the US and China will continue to be a theme in 2019. A populist European Parliament remains a fiscal risk for the region, while a “no-deal” Brexit will almost certainly push the UK into recession. A no-deal Brexit is an unlikely event, with a second referendum being on the cards if parliament can’t come to an agreement. A break-up of the monetary union appears unlikely, even as Italy flouts EU fiscal rules.

The base case view for 2019 is that US growth momentum continues into the first half of the year before the stimulating effects of Trump’s fiscal policy wanes and growth slows to around trend in the second half of the year. A benign inflation outlook and a very flat yield curve are also expected to cause the Fed to pause on raising rates, possibly by the middle of the year. The weakening of the dollar is expected as US growth slows and the “twin deficits” increase. This will provide respite for emerging market economies (EMs).

But the catalyst for emerging markets as a collective will be a stabilisation in Chinese growth. With manufacturing activity, pressure will build on the Chinese authorities to reverse their policy of deleveraging and financial stability to pursue a more aggressive monetary and infrastructural stimulus, which is expected to stabilise growth in the second half of 2019. High levels of foreign currency denominated debt and a tightening in interest rates remain a headwind for EMs. While the base case is for global growth to slow to trend, equity markets are currently priced for a sharp contraction in earnings, pointing to a possible recession. This appears to be at odds with global PMI indices and consensus earnings estimates. These measures do point to a slowdown in growth, but they do not suggest a recession is imminent.

Rather, recession risks are seen rising in the second half of 2020 as the late-cycle expansion ends. Since equity market valuations are attractive following the sharp sell-off and derating in 2018, a late cycle rally is expected to broadly favour developed markets in the first half of the year and emerging markets in the second half. Given the risks to the global economy, however, bet sizes should be scaled back to allow for greater diversification across fixed income asset classes, particularly at the back-end of the calendar year.

Comments are closed.