July 2020 economic review

The COVID-19 pandemic, and global governments’ reaction to stave off the spread through stringent restrictions, resulted in over 90% of the world economy going through some form of lockdown during March and April of this year. The majority of countries, however, began easing lockdown restrictions within two months, facing the conundrum of saving lives versus supporting livelihoods.

Economic impact of COVID-19 becomes clearer

A clearer picture of the economic damage caused by the pandemic has arisen. GDP figures across Europe and the US collapsed during the second quarter of 2020, declining by approximately 40% and 33% respectively. As the world slowly starts to shake off the shackles of lockdown restrictions, glimmers of positive data releases start to surprise. But the rebound remains sensitive to concerns around second-wave infections that constrain the full reopening of economies. The World Bank notes that the swiftness and scale of growth forecast downgrades since April 2020 have been unparalleled – even when compared to the Global Financial Crisis in 2008.

Stimulus-led recovery means greater socio-economic disparity

The pandemic has brought us to a crossroad in financial markets. At the moment we see sentiment being mainly driven by stimulus support across both developed and emerging market economies. That said, emerging markets have had fewer resources to deploy and this has resulted in a number of economies operating below their potential, a trend that will continue well into 2021. From a socio-economic perspective, one of the by-products of COVID-19 is the clear indication that the gap between wealthy countries and their less fortunate counterparts has now become even greater.

US mega stocks lead ambitious market sentiment

The gradual easing of lockdown restrictions globally, announcements of further monetary and fiscal stimulus measures, and investor optimism that the global recession had bottomed in April all underpinned demand for both developed and domestic market equities in recent months. July was no exception. Essentially the market has been pricing in an earnings recovery to pre-COVID-19 levels (largely ignoring the prevailing months of earnings declines). This has mainly been driven by the US mega tech stocks, which reported epic earnings over the last two weeks. Apple recorded earnings up 11% from a year ago and Amazon doubled its after-tax profits by $5 billion.

What is clear is that the pandemic has created winners and losers. Industries and companies that support the stay-at-home lifestyle that has been forced upon the world population have done phenomenally well; those that rely on people leaving their homes or going out have suffered immensely.

Markets

Global

In July the MSCI World Index returned 4.8% (in USD terms) and -0.7% year-to-date (YTD). US equity markets were robust regardless of a resurgence in COVID-19 infections, which saw some US states having to reintroduce movement restrictions. The S&P 500 returned 5.6% (in USD terms) for the month and 2.4% YTD. However, it is still behind the tech-heavy Nasdaq 100 Index (+25.5% YTD), which extended its YTD lead in July, as second-quarter results confirmed the dominance of most large-cap US tech companies.

European equities appeared to be constrained by a stronger currency in July, with the Euro Stoxx 50 marginally negative in July in euros, and down 13.3% YTD. The MSCI Emerging Markets Index, led mainly by China, returned 9% in dollars in July, and have clawed back most of the losses of 2020.

In July global central banks continued to do what they could to keep interest rates extraordinarily low, an approach which seems unlikely to change any time soon. This stance, along with the prospects of intensified geopolitical risks and growing debt burdens, saw investors flocking to gold, which had its best month since 2011 as it hit an all-time high of $1 995 per ounce during the month, leaving it up 30% YTD.

Local

Economic news has not been favourable on the local front, with the emergence of further government corruption and theft accusations of COVID-19 relief funds dominating local headlines. Due to the lag in economic data releases, we are now getting confirmation of the dire state of the economy. Only over time will we understand just how long it will take and how well South Africa will heal from the economic fracturing COVID-19 has caused.

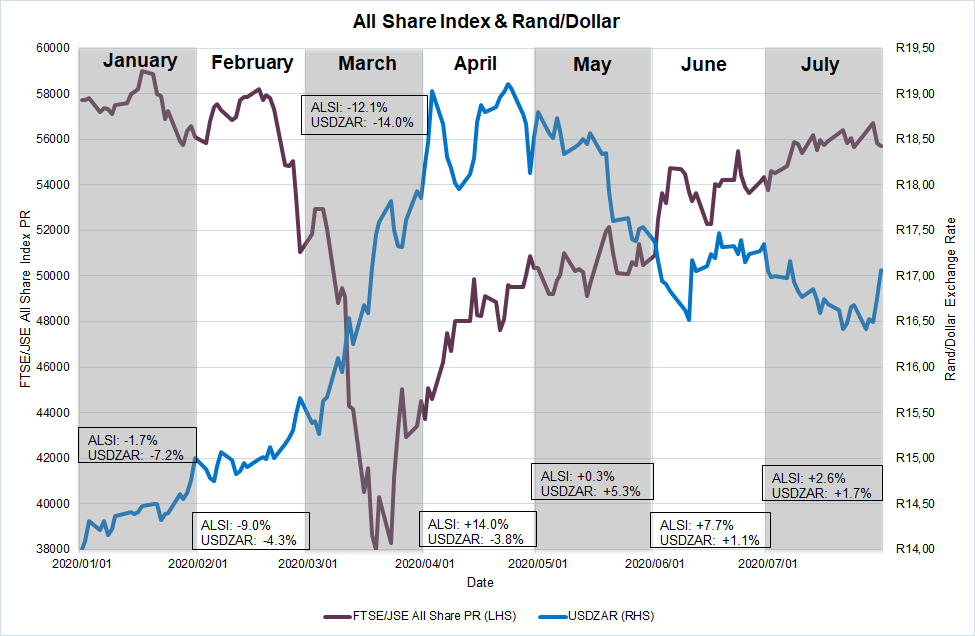

That said, local equities did have a positive month, despite the lack of positive news. The FTSE/JSE All Share Index returned 2.6% for July, managing to scrape back most of its YTD losses. It is no surprise that Resources led the sectors with an 8.3% return for the month, coming in at 15.1% on a YTD basis. On the back of the flight-to-gold moment that the market is currently having, the FTSE/JSE Gold Mining index almost doubled for 2020, coming out top with 23.2% for the month, followed by Platinum Mining’s 20.8%. Industrials delivered -1.2% for July and was up 8.4% YTD. Tencent has profited from stay-at-home activity and its dollar share price has surged. This has boosted its minority shareholder Naspers. Both Naspers and rand hedges have profited from currency weakness too. Financials returned 0.4% for the month, still down 32.6% on a YTD basis.

Among the sub-indices, various remaining lockdown bans hurt some sub-indices more than others. Tobacco returned -12.5% during the month; Travel and Leisure returned -16.5%.

Bonds were marginally positive for the month despite the significant sell-off during March and accompanying foreign outflows. The ALBI gaining 0.6% for July and 0.97% YTD. Cash (STeFI) returned 0.42% in July and 3.6% YTD. The listed property sector (SAPY) lost another 3.2% during the month and was down 39.6% YTD.

Currencies

Source: Graviton, INET, 31 July 2020

The dollar lost ground during July (about 5% against the euro) and while the trade-weighted dollar index has pulled back to 2018 levels, it remains strong relative to its long-term history. It is likely that the weaker dollar might just be a momentary reflection of the US government’s reaction to and management of COVID-19. It should be noted, though, that should the dollar weaken further, this would have positive implications for the world economy in general, and specifically for emerging markets and commodities.

Stronger commodity prices and the weaker dollar boded well for the South African rand during July, with the ZAR gaining as much as 4% against the USD, before closing the month around 2% stronger. It lost 3.9% and 3% against the sterling and euro respectively for July.

Comments are closed.