Interest Rate Hikes: A Chart-Topping Conundrum

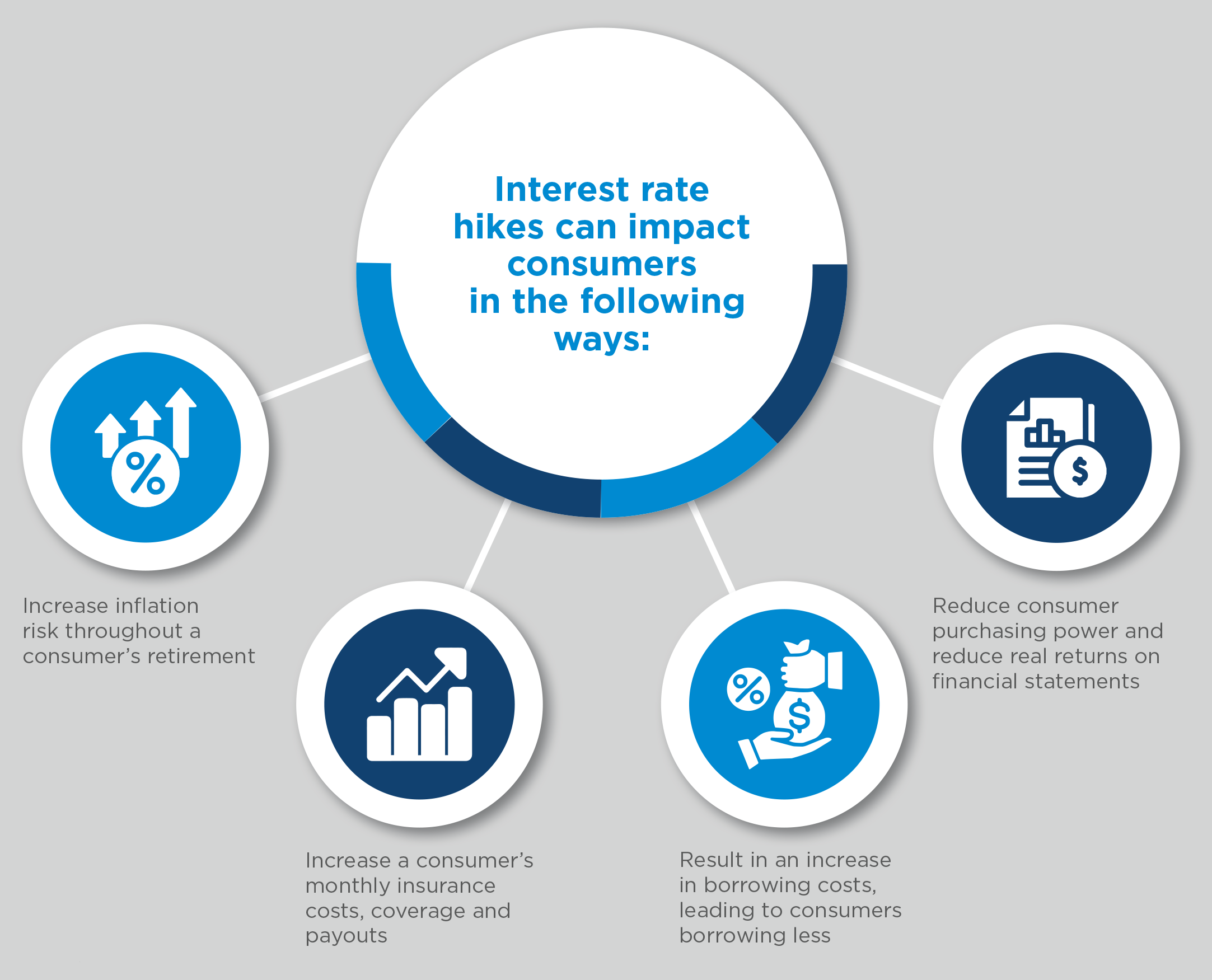

Interest rate hikes around the world have been of great concern lately. The hikes stem from (including but not limited to) inflation, supply and demand, and credit risk, all resulting in poor economic activity. Not only do rate hikes have an impact on the currency, but they also impact consumer behaviour. Below we look at interest rates from Europe, the UK, the US, and South Africa and how they impact consumer spending power.

Global Interest Rate Hikes

European interest rates

European interest rates

European interest rate hikes from

April 2022 to June 2023

UK interest rates

UK interest rates

UK interest rate hikes from July

2022 to June 2023

US interest rates

US interest rates

US interest rate hikes from April 2022 to June 2023

Local Interest Rate Hikes

South African interest rates

South African interest rates

South African Interest rates from April 2022 to July 2023

Impact of rate hikes on asset classes

Interest rates impact valuation levels across asset classes and currencies as can be seen in below:

At Graviton, we provide innovative and industry leading solutions to clients. Our Retirement Income Solution offering embraces strategies like smoothed bonus funds, which allow us to gain exposure to growth assets but control for volatility. Furthermore, we invest in hedge funds, private equity and private debt to enhance returns and manage risk. We make use of highly-developed quantitative tools to construct portfolios which should generate returns and control for risk in a unique way.

While we are living through difficult and turbulent times, we are constantly working hard to manage the present risks and opportunities for a better future.

Comments are closed.