Behavioural finance and your investments

Behavioural finance focuses on human psychology and behavioural factors to understand how we act and make decisions in the financial and investment world. It recognises that human beings are not necessarily rational and considers various motivations that investors have for making decisions.

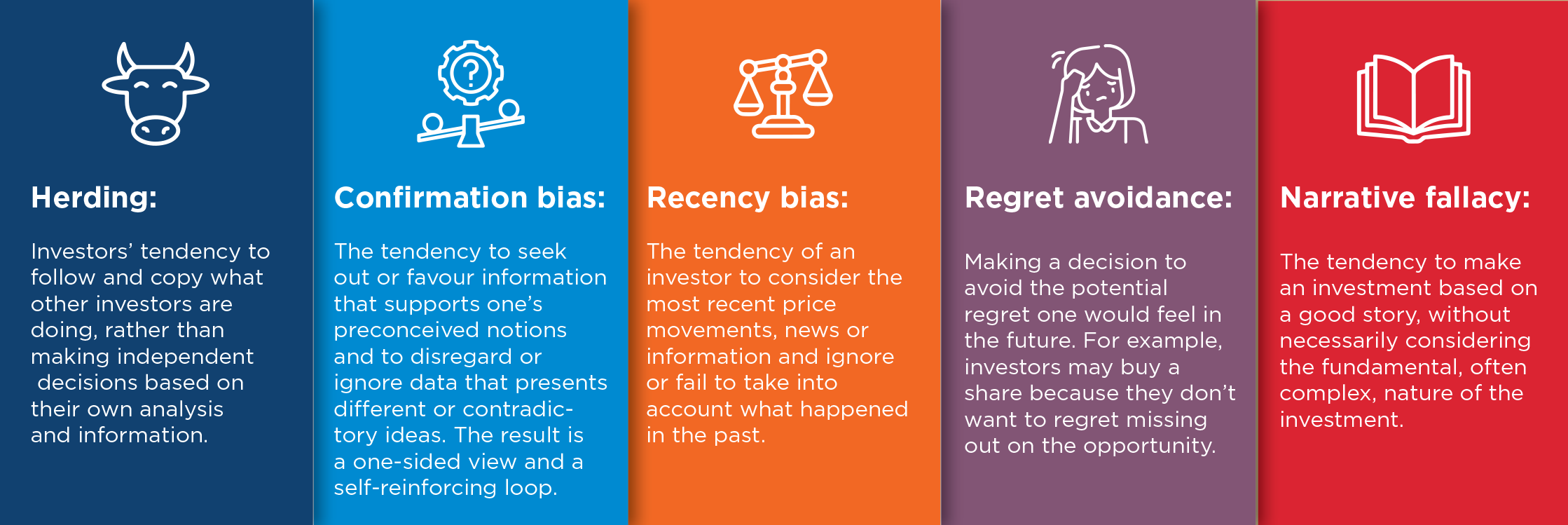

Common behavioural biases are:

Behavioural bias in the investment context

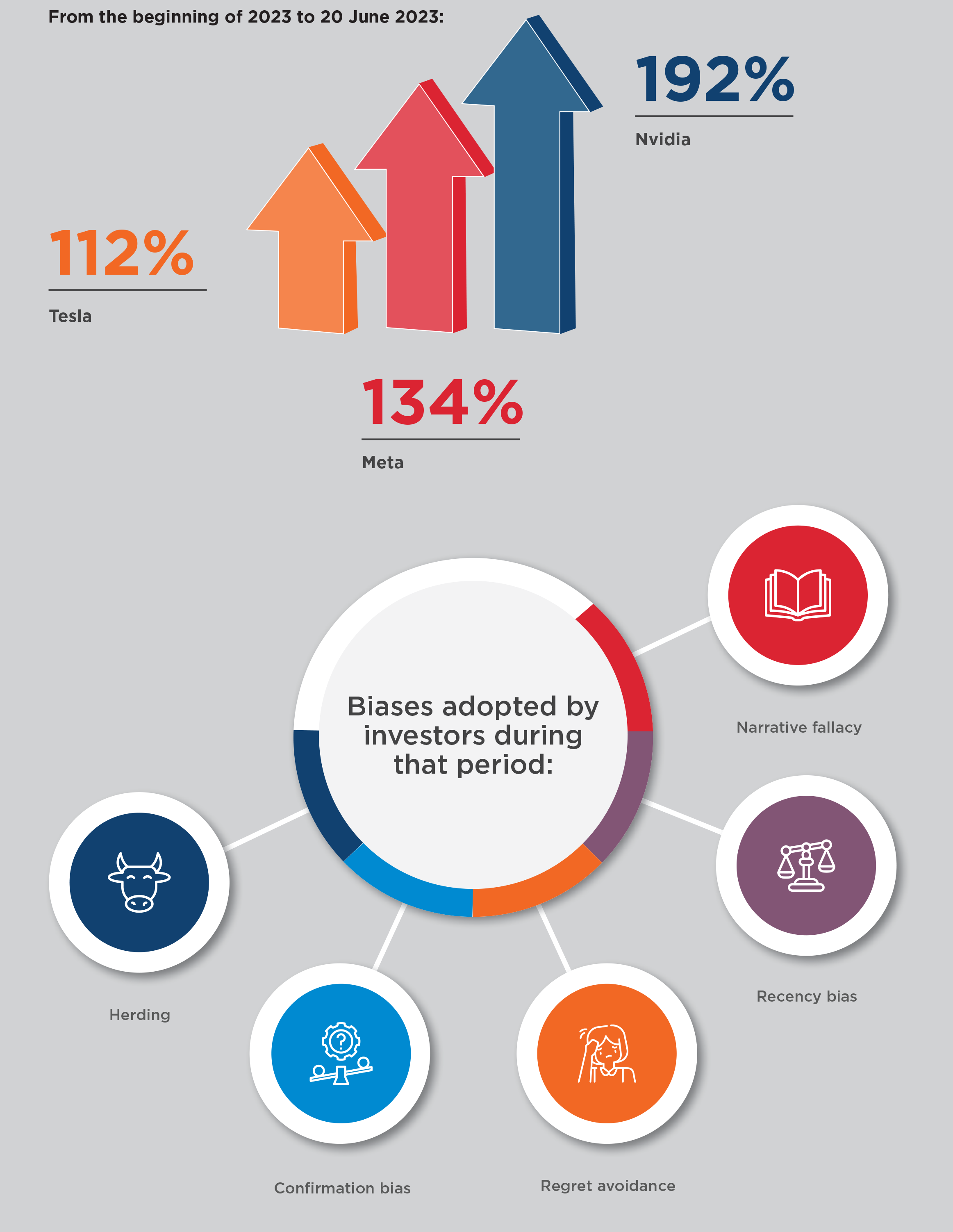

A real-world example which encapsulates all the behavioural biases described is the dot-com stock market bubble from 1995 to 2000 and the S&P 500 bull market boosted by a rise in tech stocks. The dot-com bubble saw the value of equity markets grow dramatically. Between 1995 and its peak in March 2000, the Nasdaq Composite Index rose 800%. With regards to the S&P 500, at the end of May 2023, just seven stocks – Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet were up 44% from the beginning of the year. From the beginning of 2023 to 20 June, Nvidia was up 192%, Tesla was up 112%, and Meta was up 134%. One can easily see how biases such as herding, confirmation bias, regret avoidance and recency bias all combined with the narrative fallacy to lead to poor investment decisions.

Impact How does Graviton lessen the behavioural bias impact?

Comments are closed.