March 2021 economic review

The past year may have felt like a decade to most, in part due to being locked down in our homes for most of it, but also due to the wide range of outcomes we’ve experienced in financial markets. It was also a year of trying banana bread recipes, discovering the multiple uses for pineapples, running 5km in your garden, and listening to the first “family meeting” address of our president in March 2020.

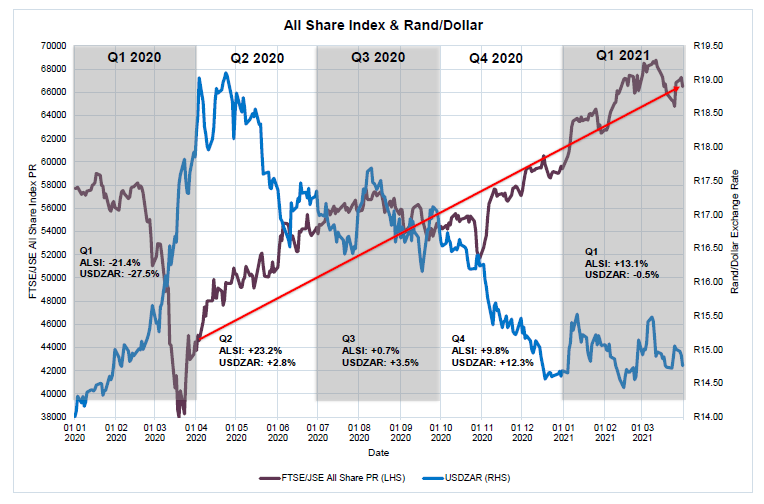

2020: A combination of a V-shaped and K-shaped recovery

Source: Graviton , INET, 31 March 2021

Since then we’ve observed an incredible triumph of the human spirit and scientific evolution. A viable and efficacious vaccine was rolled out well ahead of expectations and now we have many credible vaccines to try to contain COVID-19 once and for all. After an alphabet soup of predictions, it was a V-shaped recovery which characterized financial and economic data last year, but we also unfortunately observed a K-shaped recovery as global inequality was highlighted once again by the events of 2020. While 2020 will be defined by the sudden economic halt and spread of COVID-19, 2021 will be defined by the speed and effectiveness of vaccine distribution around the world. A key determinant of 2021 will be the evolution from efficacy to effectiveness.

Heading into 2021: US stimulus leads to inflation concerns

The year 2021 started off well for investors as financial markets continued their momentum from the fourth quarter of 2020 in spite of global lockdowns and new waves of COVID-19 infections. The victory of the US Senate and House of Representatives (“Blue Sweep”) helped to buoy investor sentiment as President Joe Biden was inaugurated and the Democratic Party could proceed in implementing their COVID-19 recovery plan and fiscal stimulus measures. After being found complicit in the insurrection at the US Capitol, former President Donald Trump was impeached for a second time and quickly disappeared from the headlines as social media companies banned him from their platforms. The House of Representatives passed a $1.9 trillion stimulus package which further supported global markets. Talk then quickly turned to the fears of higher-than-expected inflation after all the stimulus measures as investors began to sell US long-dated bonds, pushing yields higher. Equity markets lost their momentum as bond yields in the US rose and Value continued to outperform Growth from an investment style perspective.

Investors in SA treated to excellent returns in 2021

On the local front, we also benefitted from a decline in COVID-19 infections after a devastating resurgence over the festive period. As I write this, we’re currently on Alert Level 1, with all eyes on the infection rates data after an expected busy Easter period in South Africa. The rollout of vaccines has been slow, with only healthcare workers currently being inoculated after government’s multiple attempts to procure large amounts of vaccines. While good news slowed, investors were still treated to some excellent returns as the JSE followed global markets higher in the first quarter of 2021. The rand traded between R14.50 and R15.50 to the US dollar as local and global developments affected sentiment sharply on a regular basis. Rising US bond yields, increased COVID-19 cases in Brazil, and Turkey’s firing of their finance minister also dampened sentiment towards emerging markets towards the end of the first quarter. Interest rates were kept on hold at 3.5% after recent MPC meetings, and Finance Minister Tito Mboweni delivered a reasonable budget speech in line with market expectations.

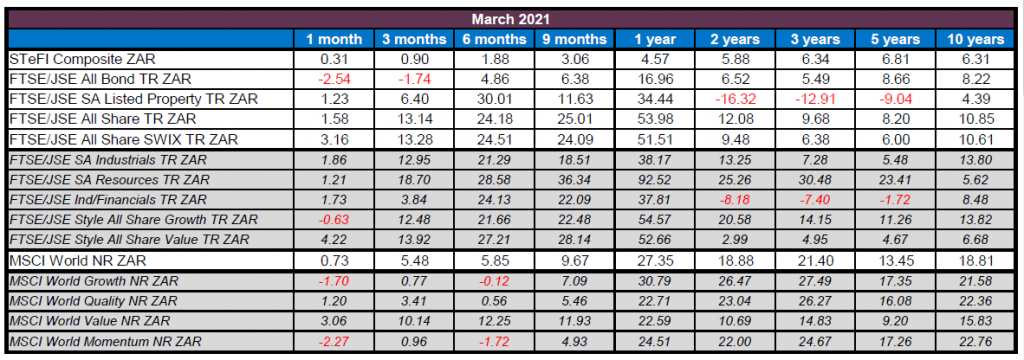

Source: MorningStar, 31 March 2021

Where to from here?

“…every past market crash looks like an opportunity, but every future market crash looks like a risk” – Morgan Housel.

While one-year returns look incredibly strong at the moment, the question remains: where to from here? While investment outcomes are random in the short term, we still believe it’s prudent to remain invested according to investors’ long-term objectives and asset allocation requirements. With interest rates at record lows and the inflation trajectory expected to be upward, we don’t see value in investing in cash-like instruments for expected returns. We remain committed to the active management of risks within portfolios and will continue to engage with you in these rapidly changing times.

Stay the course.

Comments are closed.